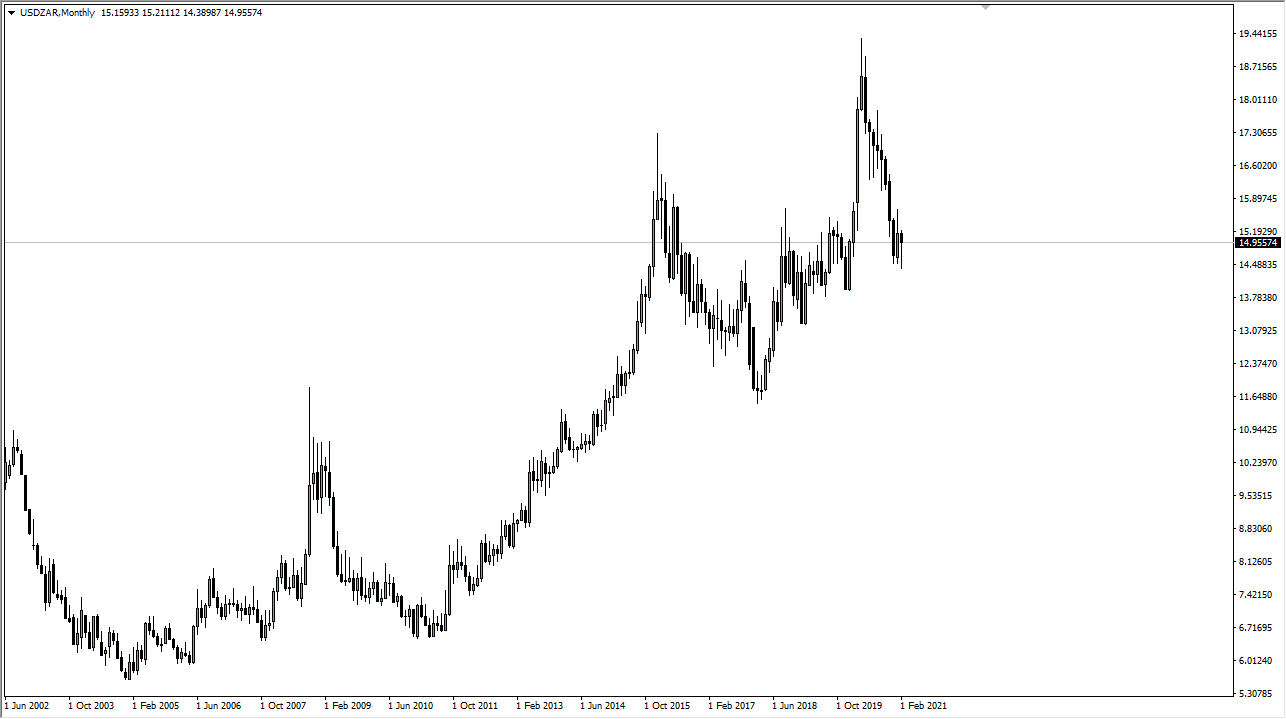

The US dollar has spent most of the month of February bouncing around between the 15.13 ZAR level and the 14.50 ZAR level. This is an area where we had seen an impulsive spike higher in the past and have been drifting lower from for some time. There are questions about the interest rate differential going forward, as the yields in the bond market in America continue to climb. As they climb, that does make the possibility of yield differential between the dollar and the rand throw this market into disarray. After all, South Africa offers 3.5%, which is relatively attractive, but if the greenback continues to offer more in the way of yield, you are likely to see people willing to jump in the US assets quicker. In a way, you should be paying more attention to the bond market than the currency market if you are going to trade the South African rand.

As we have rising interest rates in the United States, that has people buying bonds, and they need to use US dollars to do so. That drives up demand for the greenback against the rand, especially as South African investors pile into the US. Furthermore, if there are a lot of concerns about growth around the world, that does have a negative influence on the South African rand, as it is considered to be an emerging market. (As a side note, if the South African rand were to fall in strength, it could be good for equities in that country.)

As far as breaking down below the support level, we need to drop below 13.91 rand in order to see a bigger move to the downside, something that I do not necessarily think we will see during the month of March. I think March is probably going to be more about the US dollar bouncing a bit against the South African rand, perhaps trying to reach towards the 15.65 rand level, as we had reached that general vicinity during the month of January. We are still very much in an uptrend from a longer-term perspective, so it will be interesting to see if we can break above there. If we do, then the greenback could really start to rally at that point and go looking towards 16.50 next.