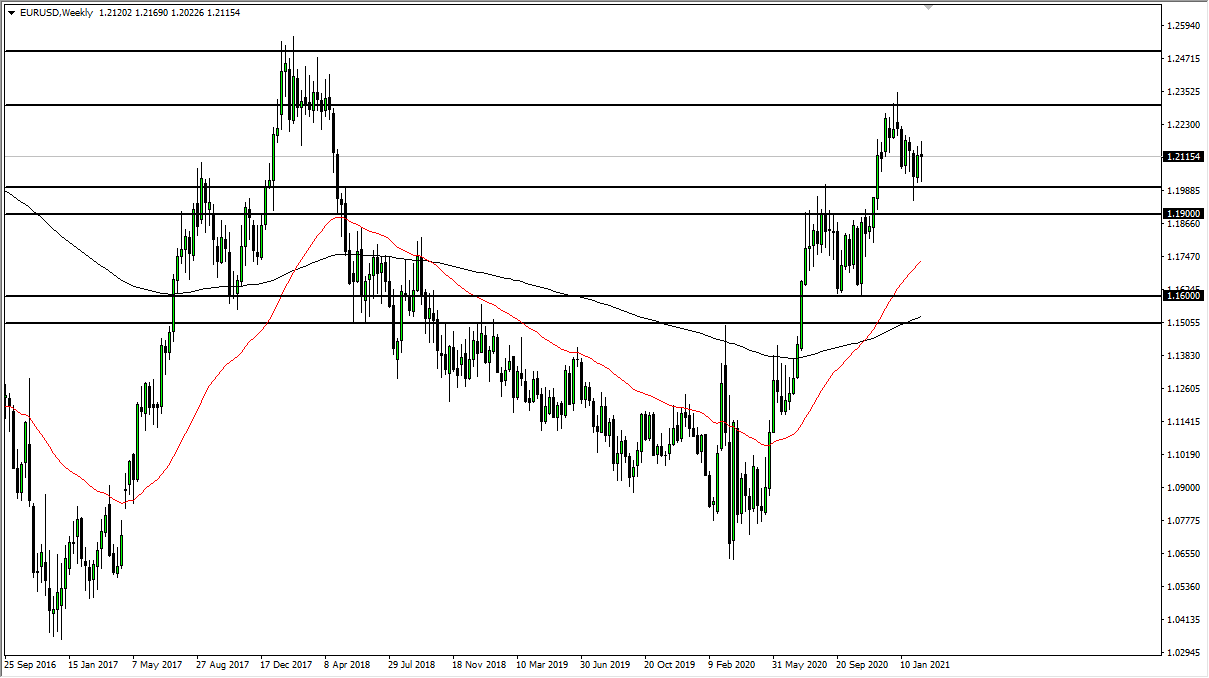

EUR/USD

The euro fluctuated during the course of the week, reaching as low as the 1.20 region before forming a hammer after the massive bounce. At this point, the market looks as if it is ready to continue to try to rally from here and go higher, maybe reaching towards the 1.23 level. In general, I believe that this market will continue to go back and forth over the next several weeks, because we have the issue of the European Union locking everything down, but at the same time there is stimulus in the United States that could work against the dollar. In general, this is a market that will continue to chop back and forth and go looking for some type of certainty.

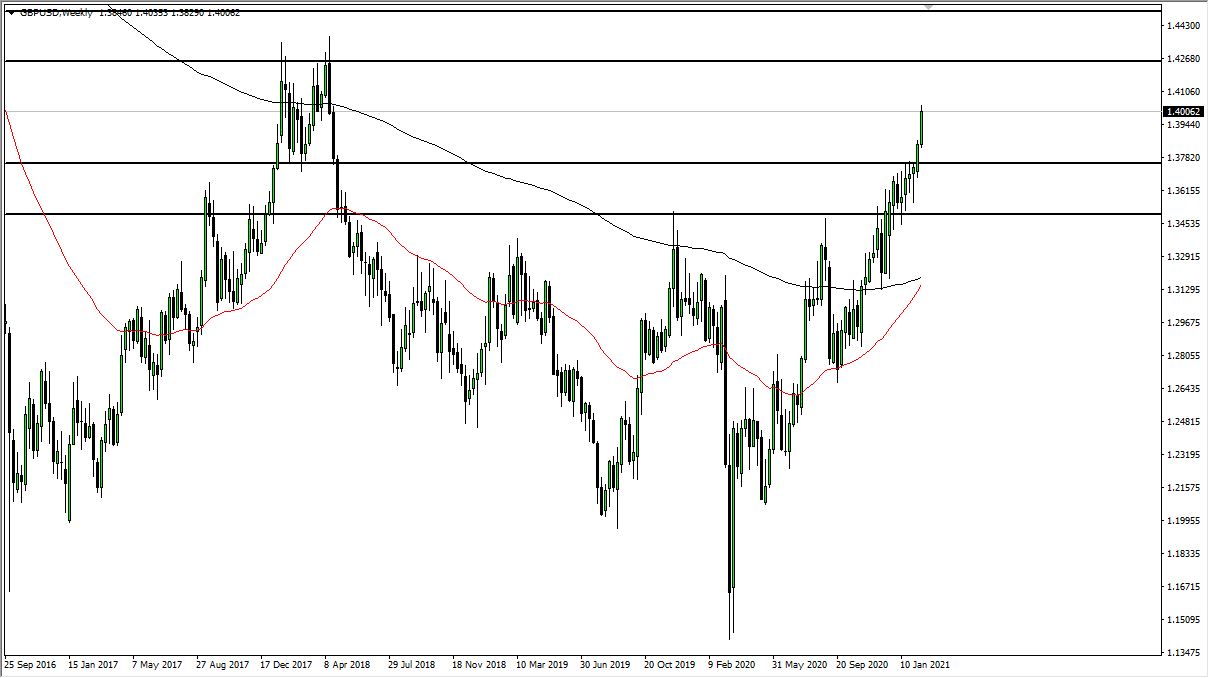

GBP/USD

The British pound rallied significantly during the course of the week to break above the 1.40 level during the Friday trading session. What is interesting is that we could not stay above there very decisively, so we could get a short-term pullback. That short-term pullback could be a buying opportunity, and I would look at the 1.3750 level as a massive support level, as it had been massive resistance. From a longer-term standpoint, I believe that the market is probably going to go looking towards the 1.42 handle where I see massive resistance. Until proven otherwise, I am a buyer of dips.

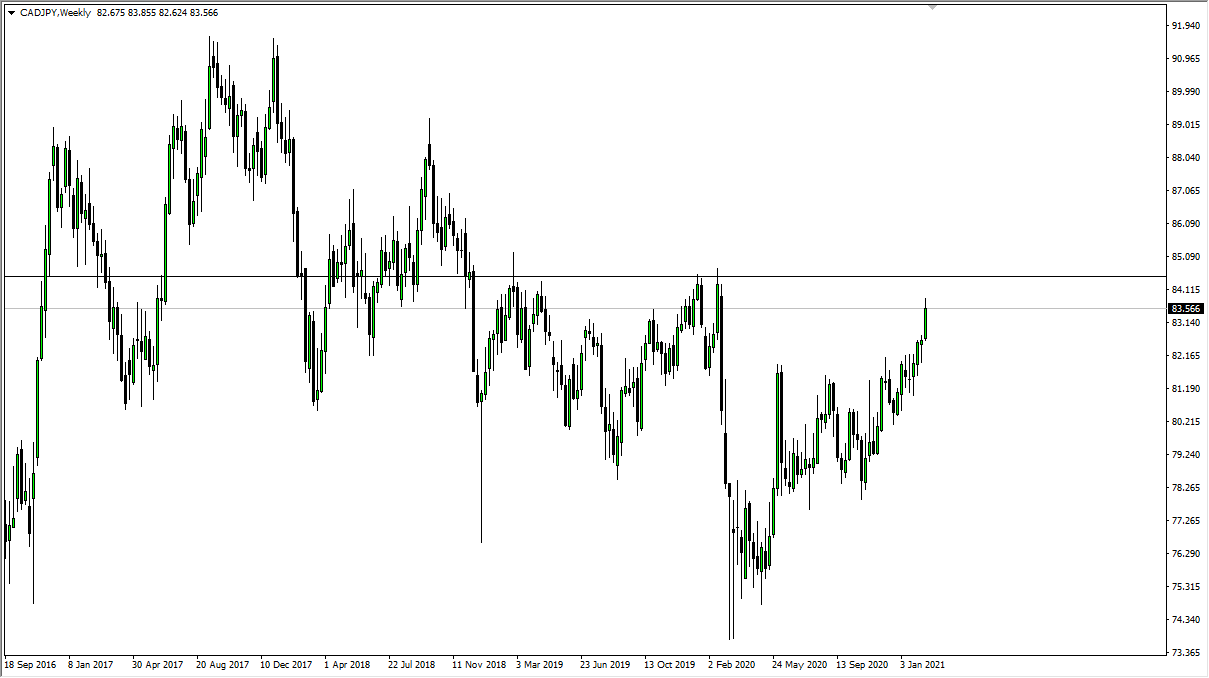

CAD/JPY

The Canadian dollar rallied during most of the week to reach above the ¥83.50 level. That is an area that is minor, and I believe that we have another 100 pips to the upside that we are trying to fill out. The ¥84.50 level is an area that I think will be a bit difficult to overcome. Much like the GBP/USD pair, I think that short-term pullbacks are going to be thought of as buying opportunities, with the ¥83 level offering a significant amount of support on short-term charts. Keep an eye on oil, as it could work against this pair. But only time will tell.

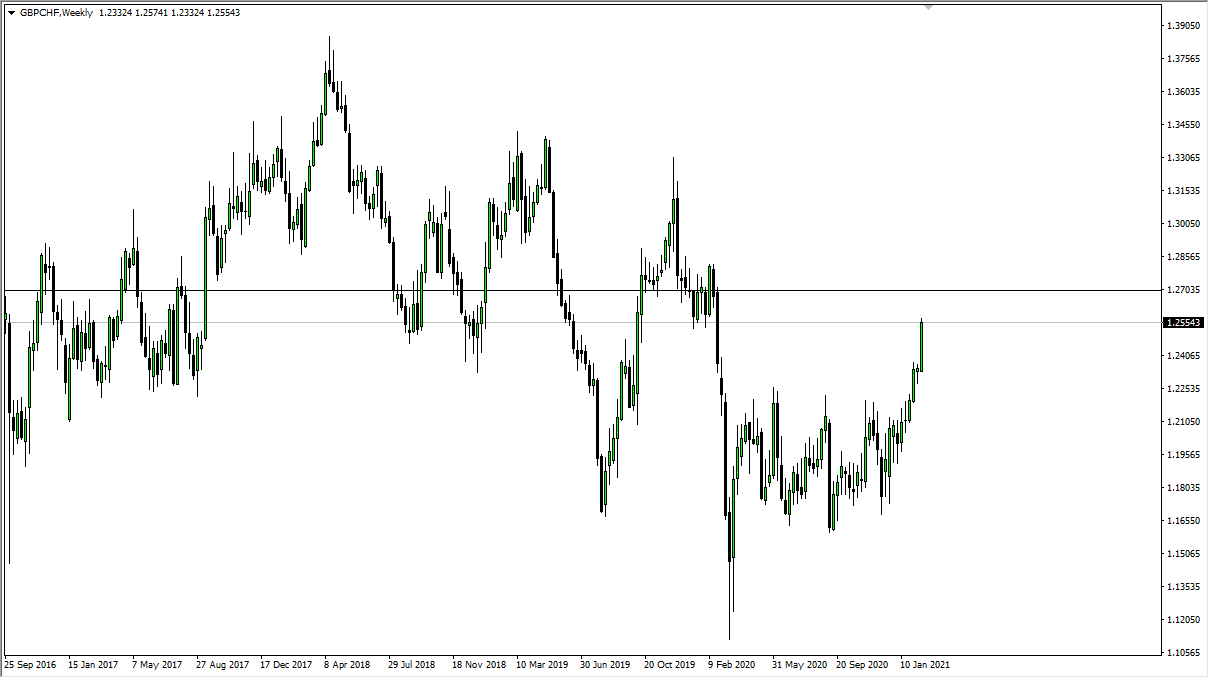

GBP/CHF

The British pound shot straight up in the air during the course of the week, as we continue to see a major “risk on” type of situation here. The Swiss franc is considered to be a safety currency, so this is a huge move to the upside and suggests that there are a lot of traders out there looking to get farther out on the risk curve. It is also worth noting that gilts are starting to offer more in the way of yield, so I think the British pound will continue to rally overall. Switzerland has negative yields, so it is not a real stretch to think that this pair should continue to go towards the 1.2700 level that I have marked on the chart. I would prefer to see short-term pullbacks before going long.