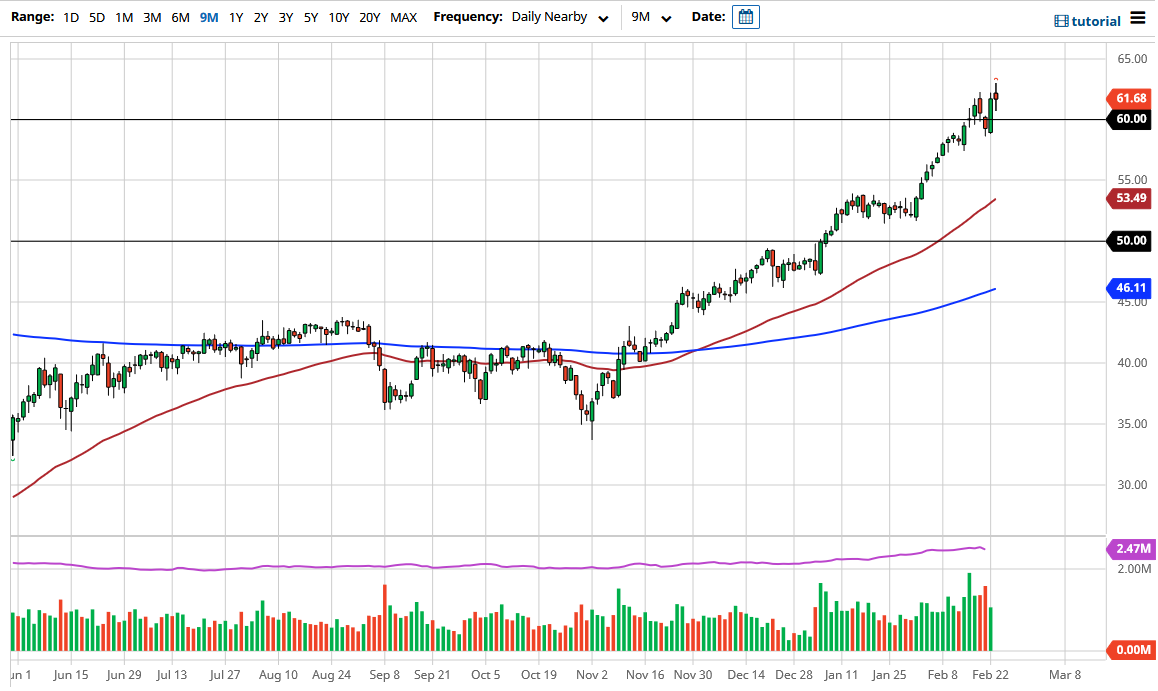

The West Texas Intermediate Crude Oil market fluctuated significantly during the trading session on Tuesday as it looks like the market is a bit overdone. The market has been very parabolic as of late, and the previous weekly candlestick was a shooting star. We have broken above there during the trading session on Tuesday, which is obviously very bullish, but ended up with a less-than-convincing candlestick. In this scenario, it certainly looks as if the market is in real danger of being overdone, and I think that a pullback makes the most sense. The $59 level underneath would be the bottom of the Friday and Monday candlesticks, and I think that would be an area that could be where buyers come back in, but if we were to break down below there, the next support level is closer to the $57.50 level and breaking down below that level would have this market really start to fall apart. That does not necessarily mean that it would be the end of the trend, but perhaps a way to work off some of the froth.

Many of the Texas refineries are now within a few days of going back online, which is roughly 40% of US oil production. Ultimately, that allows for crude oil supply to pick up quite nicely, and that will have to be factored into the price. If the market were to break above the top of the candlestick, that would open up the possibility of the market to go looking towards the $65 level. That is an area that has been massive resistance more than once. This is a level that has been where a ton of supply has come back into the marketplace before, and the level where the market broke down from before the COVID-19 outbreak happened. In other words, it is probably about as far as this market can go. We have stretched rather quickly to the upside and therefore I think that you have to ask the question “Who is left to continue buying at this point?” Furthermore, we are starting to see a lot of headlines about the beginning of a “commodity super cycle”, which in and of itself could be a negative sign. All of the “smart money” has been in this market for a while.