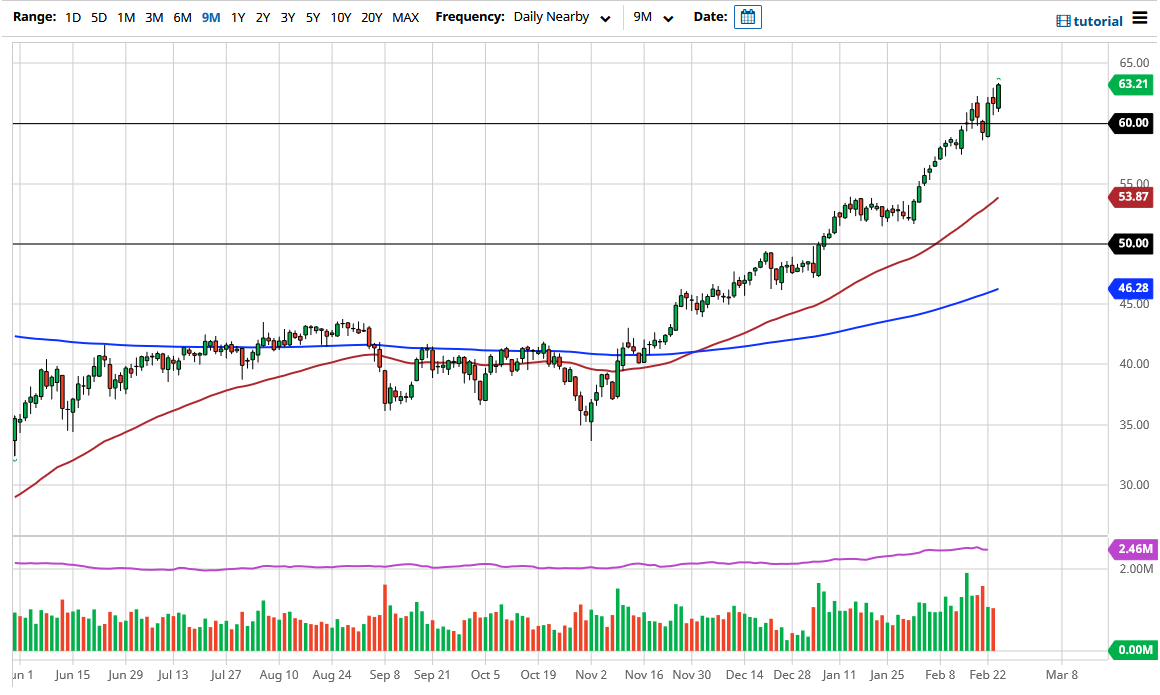

The West Texas Intermediate Crude Oil market has rallied again during the trading session on Wednesday to break above the $63 level. This is quite remarkable, because we have broken above the top of a shooting star on the weekly chart, but furthermore, we have seen the American Petroleum Institute release inventory figures that showed a build in petroleum as well as gasoline that blow out the concept of massive demand coming out and chewing through the supply.

In fact, it was roughly a 4 million-barrel swing in the wrong direction. However, the market seems to not care, as we continue to see significant amounts of bullish pressure. Now that we have gotten a bit parabolic, it looks like we are going to continue to see a move towards the $65 level. The $65 level is where we have seen massive selling come into play multiple times, even before the pandemic. With that in mind, I believe that we will probably see a significant amount of downward pressure in that area. We cannot continue to build inventories and expect prices to go higher. This was a bit counterintuitive, but perhaps people are still banking on the idea of massive stimulus and the “boom” in the economy as soon as things open up.

Currently, some people are predicting the economy to open up to previous levels as soon as this summer, which is quite laughable. However, it is what it is, and the market is trying to price that in. I would be very interested in seeing how this market behaves at the $65 level, because it could either be a massive breakout to the upside just waiting to happen, or it could be where we see the market probably pull back a bit. It did look like we were starting to last week, but the fact that we have blown through the shooting star from the previous week certainly negates that, at least at this moment. Short-term traders are probably buying dips in order to play a bounce off the $60 level, but you need to be quick with those trades because we clearly are “long in the tooth” when it comes to the trend. Regardless of which you do, I would keep my position size relatively small at this point.