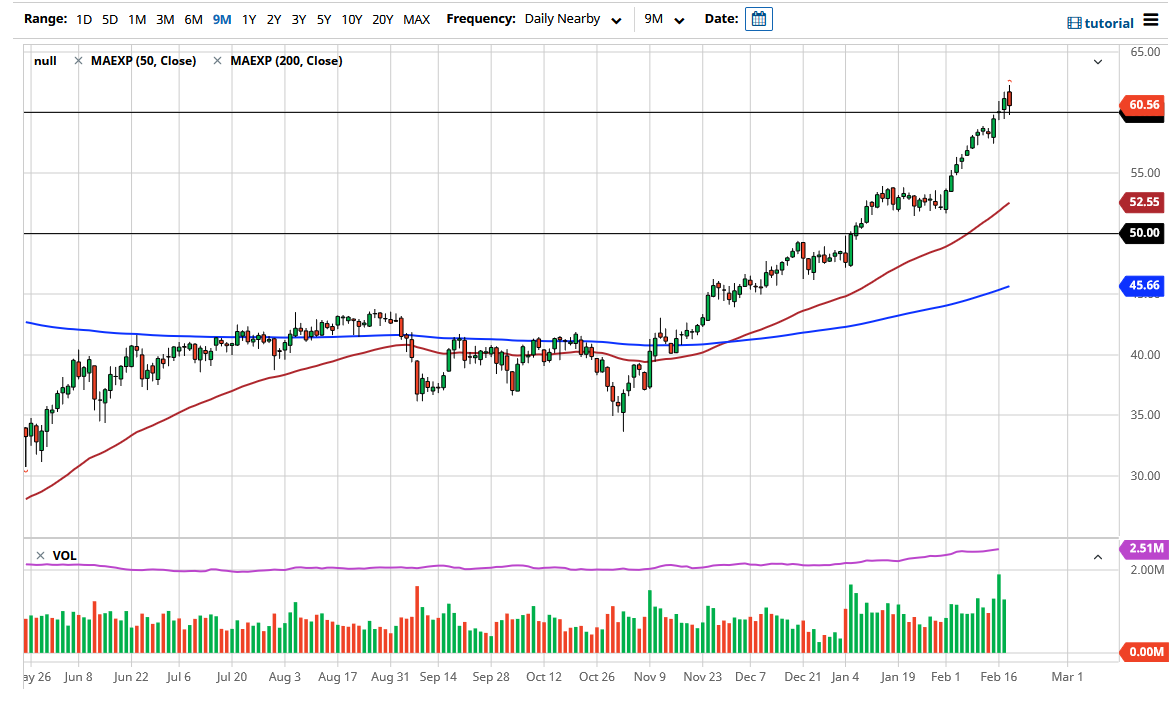

The West Texas Intermediate Crude Oil market initially rallied during the trading session on Thursday only to turn around and sell off and reach down towards the $60 level. The inventory numbers from the previous session already gave a bit of a “heads up” as to where the numbers would be for the trading session on Thursday. That being said, I think the biggest thing that we have going on here is the fact that the market has simply gone straight up in the air. After all, the market is likely to see a bit of profit-taking as we had broken out before, so with that being the case it is only a matter of time before the market needs to pull back. If we can break down below the $60 level, then it is likely we could go down to the $57.50 level.

Crude oil is basically moving on the idea of the economy turning around as the coronavirus gets eradicated, and of course the “pent-up demand” that is out there. Ultimately, I think that the market is a “buy on the dips” type of situation, as the market is obviously extraordinarily bullish. That being said, we are far overdone so I would not be surprised at all to see a significant pullback, perhaps even as low as $55. If we get down there, then the 50 day EMA will come back into play.

From a longer-term perspective, I think that the market probably goes looking towards the $65 level, and therefore that is an area where I think that there will be a certain amount of profit-taking as well. When you look at the weekly chart, you can see that the $65 level is crucial from a supply situation, and of course it is only a matter of time before people begin to realize just how “fully priced in” the economic recovery is, and therefore think oil only has a little further to go. That being said, I am not willing to short this market anytime soon, although I do think that an excellent selling opportunity will present itself in the next couple of months. Between now and then, I think that traders will come in to pick up oil “on the cheap” on every dip as it is an obvious bull market.