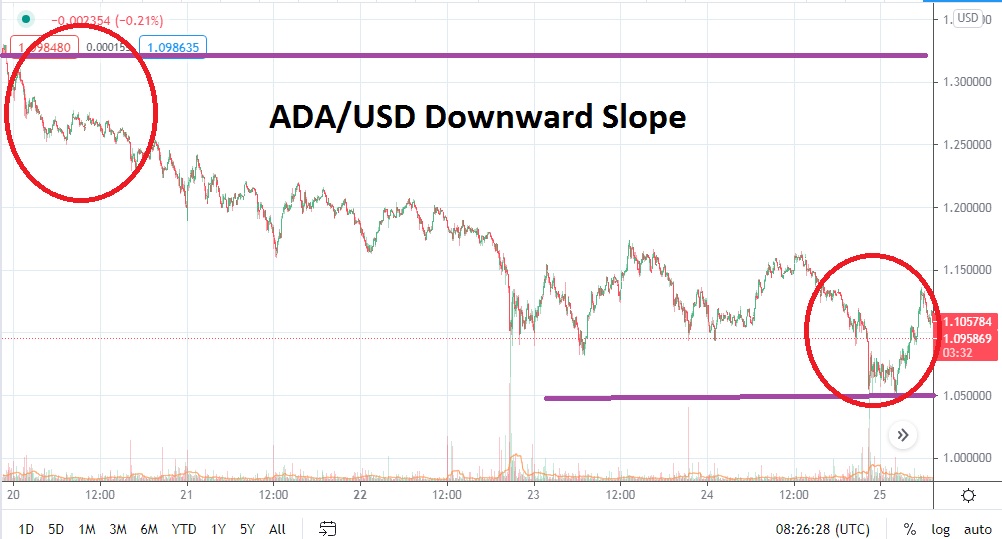

ADA/USD has seen an incremental sell-off gather additional momentum in the past day and its price is hovering over technically important support levels which could prove a vital inflection point for speculative wagers. ADA/USD suddenly finds itself hovering near the one dollar and ten cents juncture. Pressure downward has been rather consistent the past week after ADA/USD came within sight of the one-and-a-half dollar mark on the 18th of March.

The broad cryptocurrency market has taken a spill the past day and prices across the board are challenging important support levels. What makes this particularly interesting for Cardano is that exuberance in the broad crypto market has shown less buying power the past week and, after the run higher by a large number of digital currencies, they were not able to break through to new highs.

Speculators know that new highs do not have to be achieved all the time within assets, but the inability of ADA/USD and others to bounce off support levels the past few days may be signaling that bearish sentiment is creeping into the trading landscape. ADA/USD was able only last week to challenge all-time values, and it is still well above its forty-two cents ratio, which was seen on the 4th of February.

However, speculators may be looking at the one-dollar mark now with ADA/USD and wondering if it should be targeted. If the current price of ADA/USD is sustained under the one dollar and ten cents value near term, it may begin to trigger additional selling if traders decide to cash out winning positions instead of holding on long term.

Like all cryptocurrencies, ADA/USD is a speculative asset and traders need to practice caution via solid risk-taking tactics. If current support slightly above the one-dollar mark fails to hold, traders may be tempted to look for value below, which has not been genuinely tested since the third week of February.

The one-dollar mark for ADA/USD is crucial, because if it is proven vulnerable, it might indicate that the bullish run up seen the past month of trading is running out of power. Selling ADA/USD is speculative and stop loss orders need to be used, but looking for further price erosion from Cardano short term may prove an opportunistic wager.

Cardano Short-Term Outlook:

Current Resistance: 1.145000

Current Support: 1.030000

High Target: 1.220000

Low Target: 0.950000