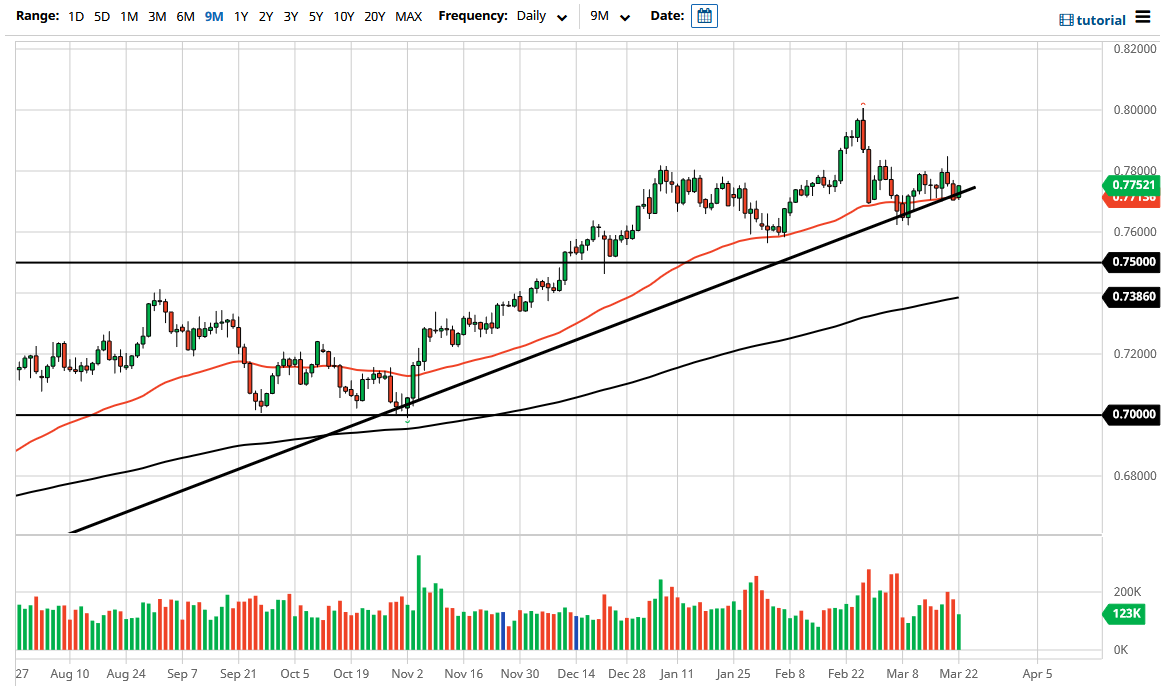

The Australian dollar has bounced from the uptrend line that has been so important as of late, and therefore it looks as if we are going to the 0.78 level where we have seen a lot of resistance previously. I think the Australian dollar is going to continue to be very messy, as the 0.78 level has been massive resistance recently, but we have also seen a massive shooting star from the month of February that shows extreme negativity.

All things being equal, this is a market that looks as if it does want to go higher, but if we were to break down below this trend line, it is very likely that this market could go much lower, at the very least the 0.75 handle. If we break down below there, then the market could go down to the 0.71 handle. This of course probably comes along with higher interest rates in America, or some type of fear enter in the markets in general. That works against the overall risk taking attitude out there, and therefore would work against the Aussie.

The Australian dollar is highly levered to the commodity markets, which of course has been part of the “reflation trade”, and at this point I think you have to keep an eye on copper, iron, and other hard assets. Remember, Australia is a major supplier of commodities to China, so pay close attention to what is going on with Chinese economic numbers.

The area at the 0.80 level extends to the 0.81 handle as far as resistance is concerned, so if we were to somehow break above there, then it is likely that the Australian dollar could go to the 0.88 handle. All things being equal, I do not think that happens anytime soon, but it certainly looks to be the idea that a lot of longer-term traders are aiming towards. The market breaking down below the uptrend line would bring in a lot of extra selling pressure in my estimation, but we also have to keep in the back of our head that there is also the 50 day EMA in that same neighborhood as well, so that could of course come into play as well. I would anticipate that there is going to be a lot of noise in this general vicinity, especially as Jerome Powell is speaking in front of Congress of the next couple of days.