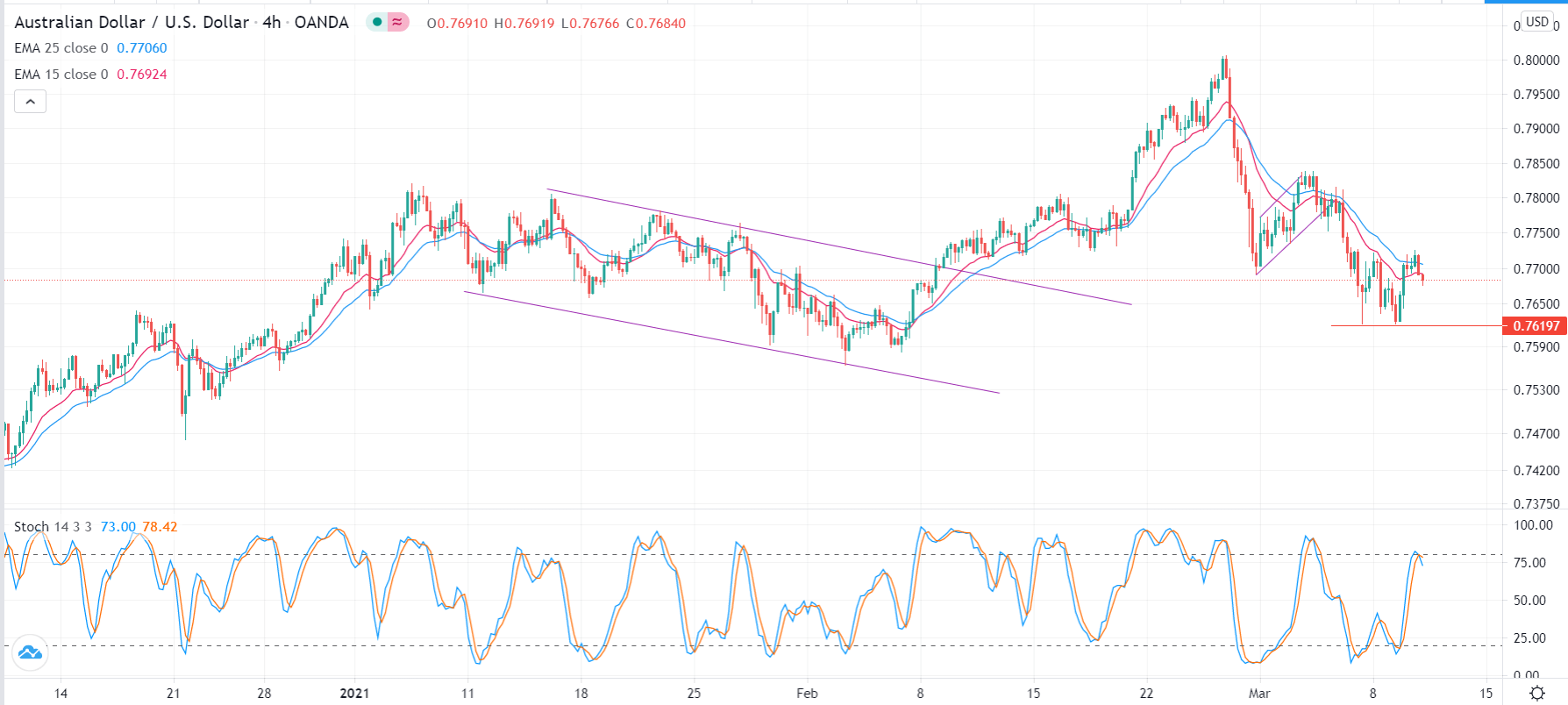

The Australian dollar rallied quite nicely during the trading session on Tuesday as we have not only closed towards the top of the range, but we have bounced from a significant uptrend line. Furthermore, we are above the 50-day EMA, which suggests that the market could go higher, perhaps reaching towards the 0.78 handle. The 0.78 handle is a large, round, psychologically significant figure, and an area where we have seen selling in the recent past. If we were to break above there, then obviously it would be an extraordinarily bullish sign.

When you look at the overall attitude of the market, it has been in an uptrend for some time, but it is worth noting that the February candlestick was a shooting star. A majority of that shooting star wick was formed in the last couple of days. There was a massive selloff, but we have not broken below this major uptrend line yet. As long as we can stay above this uptrend line, then it is very likely to be a market that will try to reach towards the highs again. In fact, the last three candlesticks in a row have seen resistance right around the same area, so if we can break through there that would add more momentum into the market.

To the downside, the uptrend line would offer support, but even below there we would probably have support at the 0.75 level as well. It is not until we break down below there that I would be concerned about the uptrend, but that shooting star from the month of February would kick off a massive trend change based upon breaking down below that level. Keep in mind that a lot of this comes down to the 10-year yield and what is going on with the US dollar. The US dollar has been strengthening due to the yields rising, and we did see a little bit of a pullback in those yields during the session which has helped the Australian dollar. At this point, the question is whether or not we can continue to see the upward momentum come into play. As long as we can, I will be a buyer. Otherwise, I will be a seller below the 0.75 handle.