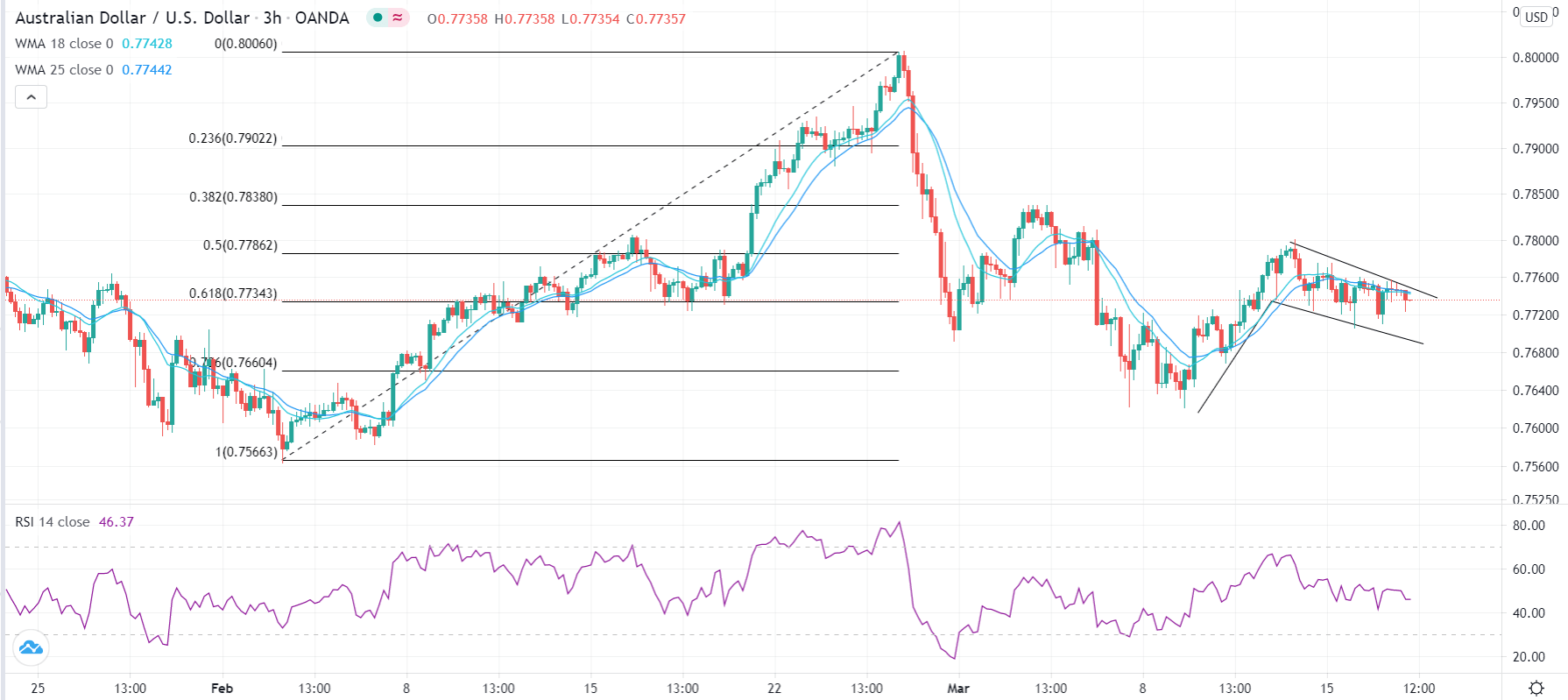

The Australian dollar has fallen a bit during the course of the trading session on Tuesday to reach down towards the 50-day EMA yet again. This is the exact same action that we had seen during the Monday session, so this really starts to pound in the idea of there being support just below at the 50-day EMA and the uptrend line that we see just below it. Because of this, I think there are plenty of buyers underneath willing to pick this market up and is something that you should be paid close attention to.

However, we unfortunately have the FOMC on Wednesday and people are taking a look at the statement and the idea of what the Federal Reserve is or is not doing about bond yields. After all, if they can keep the bond yields down a bit, the idea is that the market will punish the US dollar, and therefore allow the commodity trade to go much higher. This has a knock on effect in the Australian dollar, as the Aussie economy is so highly levered to the commodity markets.

If we can break above the highs of the last couple of days, we will challenge the 0.78 handle, which is an area where we have seen significant selling in the short term. If we can break above there, then the market is likely to go looking towards the 0.80 level which is a large, round, psychologically significant figure, and the gateway to much higher pricing. There is a resistance range between the 0.80 level and the 0.81 level, which blowing through would be a major victory for the bulls, sending the Australian dollar towards the 0.88 handle, possibly even the 0.90 level over the longer term.

To the downside, if we were to break down below the recent lows from last week, then I think it opens up a move to the 0.75 handle, and then possibly even as low as the 0.70 level. We have this major trendline that is worth paying attention to, as we walk along the uptrend line and continue what we have seen in this pair for quite some time. The market itself is waiting to see what Jerome Powell has to say tomorrow, so between now and then it might be very choppy, but we still favor the upside over the longer term from everything I see.