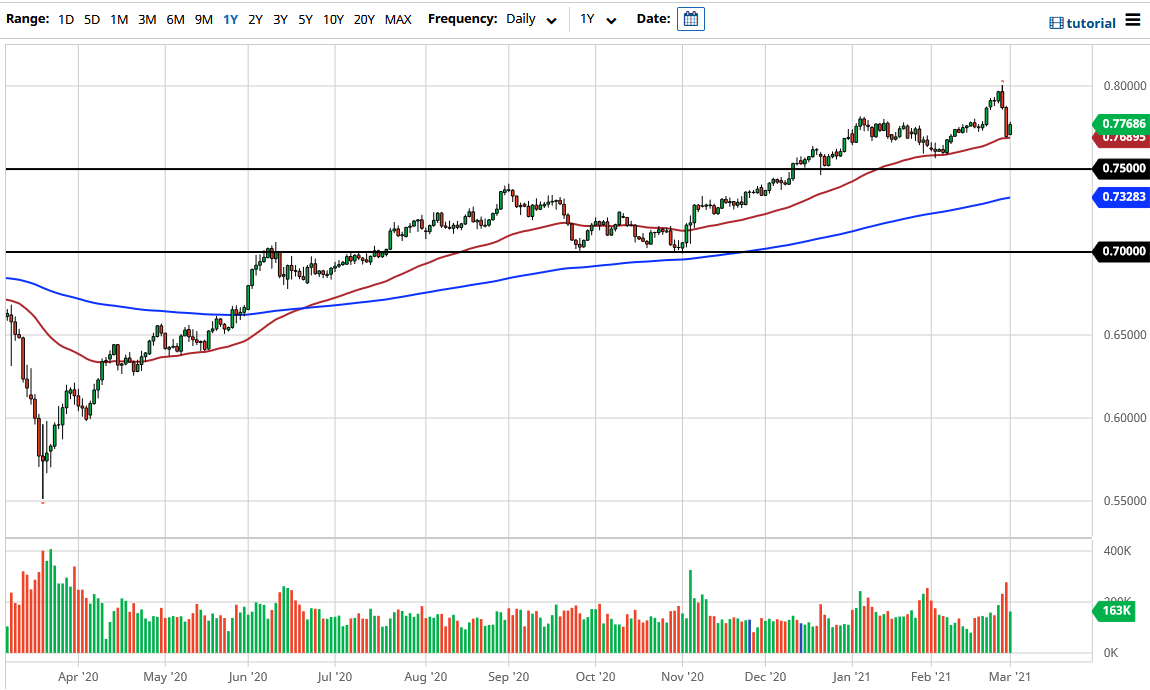

The Aussie dollar bounced just a bit during the trading session on Monday to kick off the week, as the 50-day EMA has come into play. The 50-day EMA is an indicator that a lot of longer-term traders tend to pay attention to, so the fact that it offered support is a good sign. It is also worth noting that the monthly candlestick from February was a shooting star. In other words, I think we are about to make a rather significant move, but we will have to let the market itself figure out what it wants to do before jumping in.

A break above the highs of the trading session on Monday could open up a move back towards the 0.80 level, but whether or not we can break above there would be a completely different argument, due to the fact that it is a massive resistance barrier on longer-term charts. In fact, that barrier extends all the way to the 0.81 handle, so it is on a daily close above that level that I think that the Australian dollar is free to go much higher. At that point, it could very well go all the way looking towards the 0.90 level, but it may take a while to get there.

All of this is predicated upon the idea of the reopening trade driving up the need for commodities, for which Australia is a proxy. I do not know whether or not we can simply take off to the upside, though, and I think that any move higher from here will probably be more or less a grind more than anything else. Nonetheless, the fact that we have seen massive demand for copper and iron certainly does not hurt the idea of the Aussie gaining steam. This may simply be a matter of the market has gotten too far ahead of itself, but it is worth noting that the US dollar seems to be fighting back against most commodity currencies, so the one thing that I think this probably does guarantee us is that we are going to see a lot of volatility. If we break down below the 0.75 handle, that could change the entire outlook for this pair. Until then, I expect choppiness and more or less sideways action.