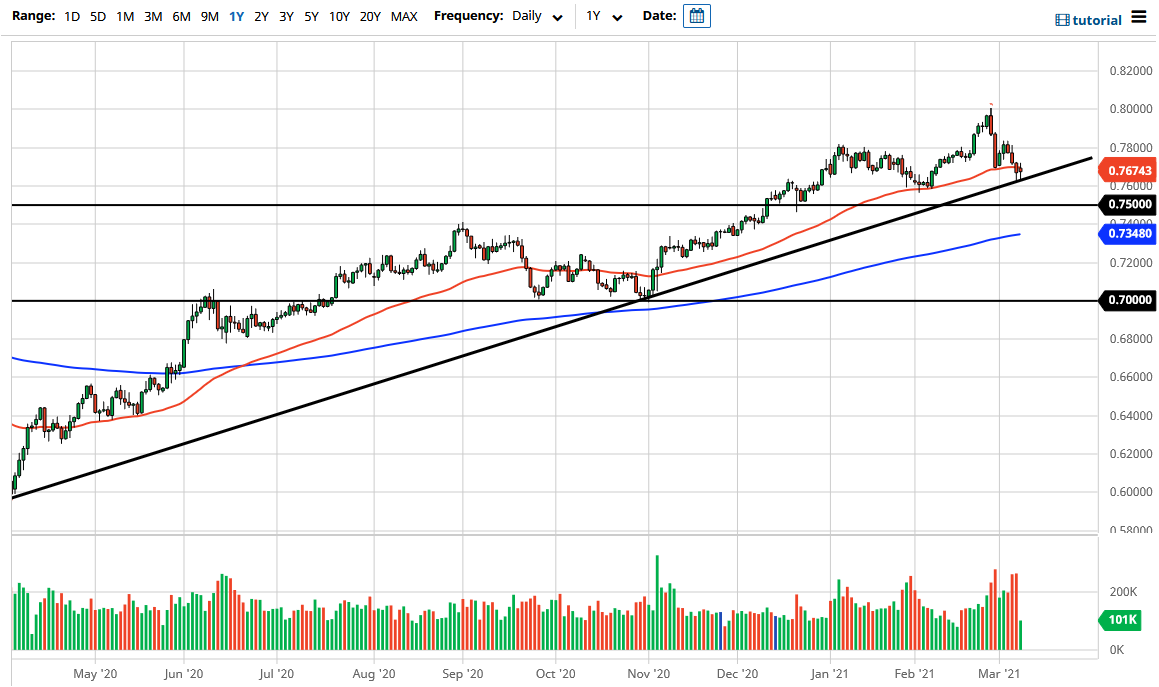

The Australian dollar initially tried to rally during the trading session on Monday but did break down a bit to reach down towards the previous trend line that we have been paying close attention to. The 50-day EMA is sitting right here as well, so that will attract a certain amount of attention. If we can break above the highs of the last couple of candlesticks, then we could make another run towards the 0.78 handle.

If we can break above there, then the market is likely to go looking towards the 0.80 level. The 0.80 level is a major barrier to pay close attention to, mainly due to the fact that the monthly charts show it as being crucial and an area where the market has seen quite a bit of support and resistance more than once. If we could finally break above the 0.81 handle, the Australian dollar will go much higher, and I would then target the 0.88 level next, followed by the 0.90 level after that. However, it is obviously an area that is going to take a lot of effort, so I would not anticipate that the Aussie dollar would simply break out right away. Furthermore, the monthly candlestick from February does have me somewhat wondering about the efficacy of a continued rally, mainly because we formed a shooting star.

The candlestick for the trading session looks a bit soft, but we do have the trend line sitting just underneath that could continue to incentivize buyers the jump back into this market. As the 10-year yield in the Treasury market is widely followed, there are a lot of headlines out there about it reaching the 1.6% during the trading session. If the 10-year yield continues to rise rather quickly, then we could see the Aussie struggle. If we were to break down below the 0.75 handle, then I would become worried about the uptrend, and would actually start to flip to a bearish trader at that point. I would look for a move down to the 0.70 level and that breakdown, so I do believe that we will see a significant move sooner rather than later, and therefore this is a market that I would be paying close attention to right now.