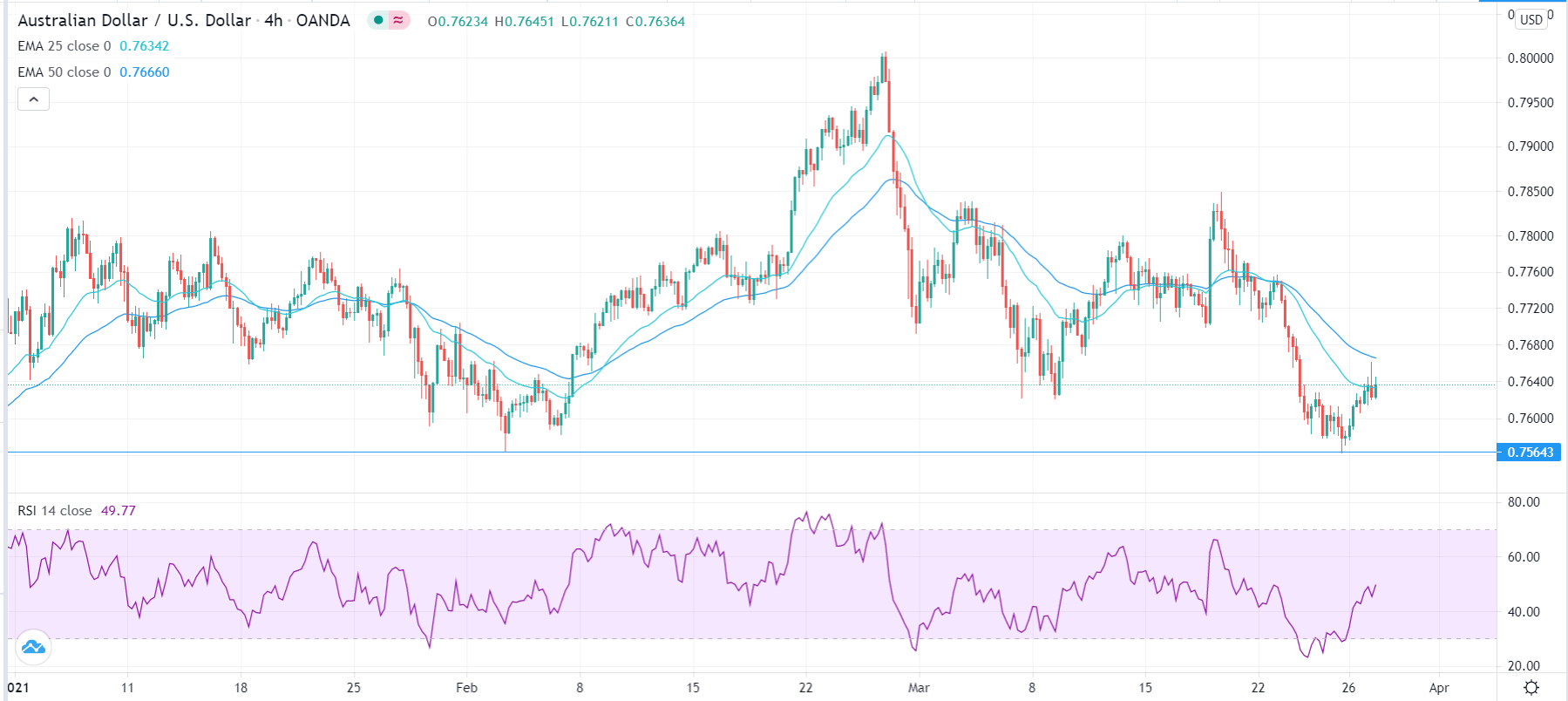

The Australian dollar rallied a bit during the course of the Friday session, reaching above the 0.76 handle. At this point, the market looks likely to continue to see choppy behavior, but it is worth noting that we have broken through an uptrend line and now it seems as if the market is going to test major support just below. That being said, you should also pay attention to the fact that the February candlestick was in fact a shooting star. We have not necessarily broken through the bottom of it quite yet, but we are knocking on the door.

If we do break down below the February lows, then I think it is likely that we will break down significantly. In fact, we could be moving towards the 0.71 handle given enough time, and as a result I would be short at this point. Rallies are not to be trusted from what I can see, and the 50-day EMA is likely to offer a bit of resistance as we are starting to roll over just a bit. At this point, I believe that signs of exhaustion after short-term rallies should be selling opportunities and that is exactly how I am going to play this market. This will be especially true if we see interest rates continue to rise in America, especially if they happen to rise rather quickly.

On the other hand, if we recapture the 0.78 level, then the market probably will go looking towards the 0.80 level, an area that has been the beginning of a massive resistance zone that has been trend-defining. If we do break above that 0.80 level, we could very well go looking to break above the 0.81 handle, which opens up the possibility of going all the way to the 0.88 level over the longer term, as that is the next major resistance barrier on the monthly charts. This obviously would have a lot to do with the reopening trade and perhaps even the stimulus coming out the United States as it seems like the Americans simply cannot stop spending money. However, if the reopening trade does not work, the Australian dollar will be one of the first places that the sellers will come back to and start punishing anyone that owns US dollars.