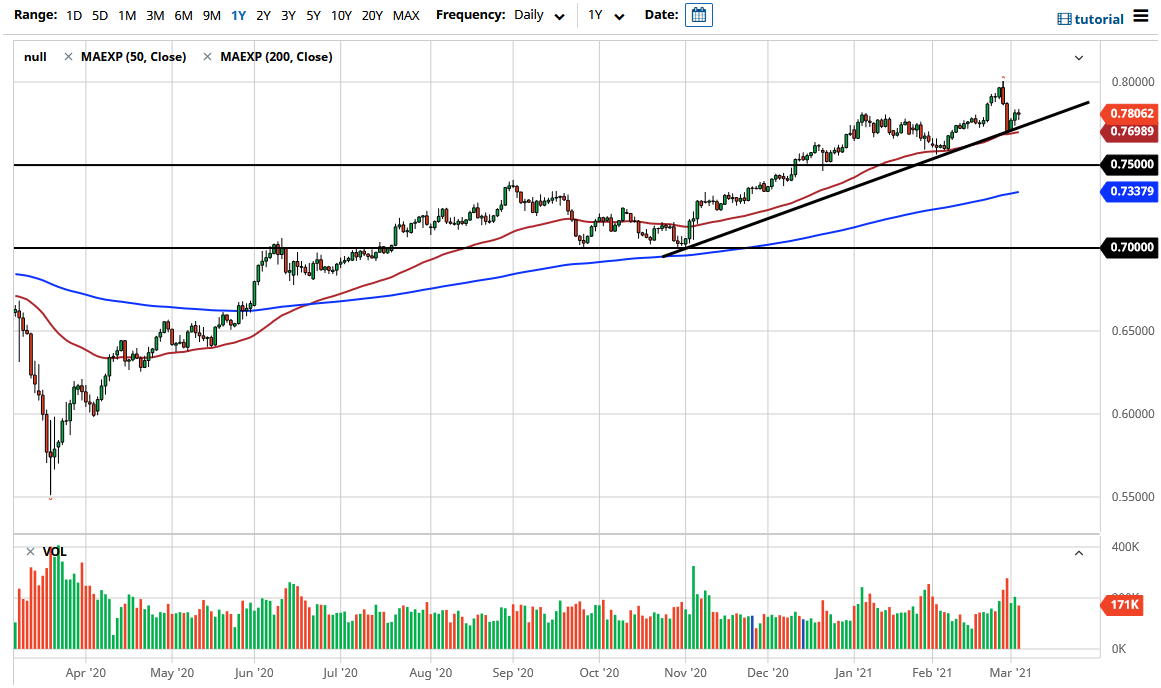

The Australian dollar pulled back just a bit during the trading session on Wednesday, showing a bit of hesitation after the bounce from the last couple of days. At this point, the market is paying close attention to an uptrend line just below, and then the 50-day EMA is sitting just below there. The market looks very likely to continue to find buyers underneath. There is the possibility that we will break down due to the fact that the February candlestick was a massive shooting star. In other words, it is very likely that we will continue to see pressure above. However, there is also the possibility that we could break down rather significantly.

Looking at this chart, we could make a move towards the 0.80 level, but it is obviously going to be very difficult to get to that level. The 0.80 level is massive resistance on longer-term charts, extending all the way up to the 0.81 handle. In fact, it is so important that you can see it plainly on the monthly charts. If we were to break above the 0.81 handle, the market is likely to go much higher, perhaps reaching towards the 0.90 level. This would be a major “buy-and-hold” type of situation, one that would certainly be worth jumping all over. However, we have to get there first, and then there is going to be the trade.

Having said all of that, if we do break down below the 0.75 handle, I do believe that the Australian dollar could get hammered. This would probably be due to spiking interest rates in the United States or something happening with the overall stimulus package situation. Remember, the Australian dollar is highly levered to commodities, and commodities are highly levered to the idea of stimulus. In other words, as long as everything that people expect to happen actually happens, the Australian dollar should eventually break out to the upside. However, it will take multiple attempts; it will not simply be something that happens in one big move. Because of this, I think the most likely attitude over the next several weeks is going to be choppy behavior, but I do have an eye on both of those big figures as they can tell us where we are going next.