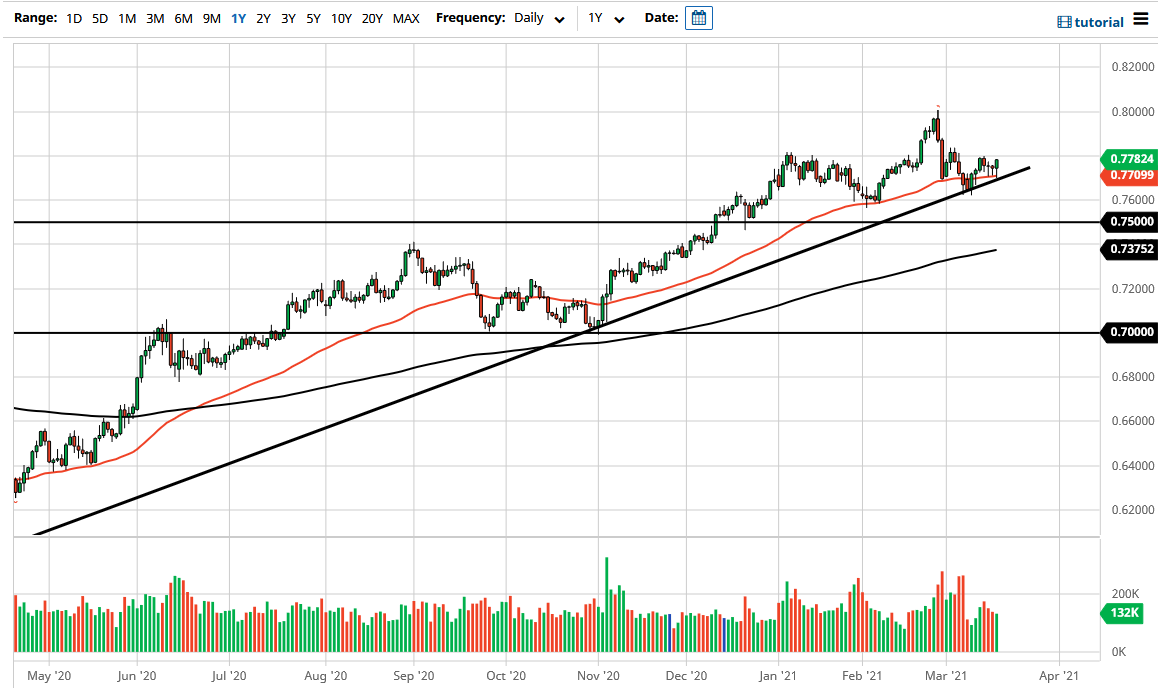

The Australian dollar initially dipped during the trading session on Wednesday but found support at the 50-day EMA and the uptrend line in order to turn around and show signs of strength again. At this point, it looks as if we are in the same pattern, meaning that if we can break above the 0.78 level meaningfully, then we can go looking towards the crucial 0.0 level. That level of resistance extends to the 0.81 handle, and I do think it is going to be difficult to break above. With that in mind, I would like to see a break above there for more of a “buy-and-hold” type of market. Until then, it certainly looks as if we can break above the 0.78 handle, and then we can make an attempt. We had a sharp pullback from the 0.80 level, but that would be expected if you look at the monthly charts.

It is also worth noting that we are walking along a significant uptrend line, so it is only a matter of time before we do continue higher, based upon what we have seen. Now that we have bounced from the 50-day EMA three days in a row, that does bode well for the efficacy of this moving average to hold things together. If we were to break down below it and the uptrend line, then the Aussie dollar would probably have some serious issues. At that point we could go looking towards the 0.76 handle, and breaking below there has me thinking about shorting the market, because the February candlestick was a massive shooting star.

I do have to point out the fact that the February shooting star was only a shooting star because of a couple of really bad days at the end of the month, which probably had more to do with yields spikes in the United States than anything else. Remember, the Australian dollar is highly sensitive to the commodities markets, and that market right now is absolutely on fire. With that being the case, I do think that the Aussie has more of a chance of going higher than lower now, and therefore I think buying on short-term dips still makes sense, at least for the next couple of weeks.