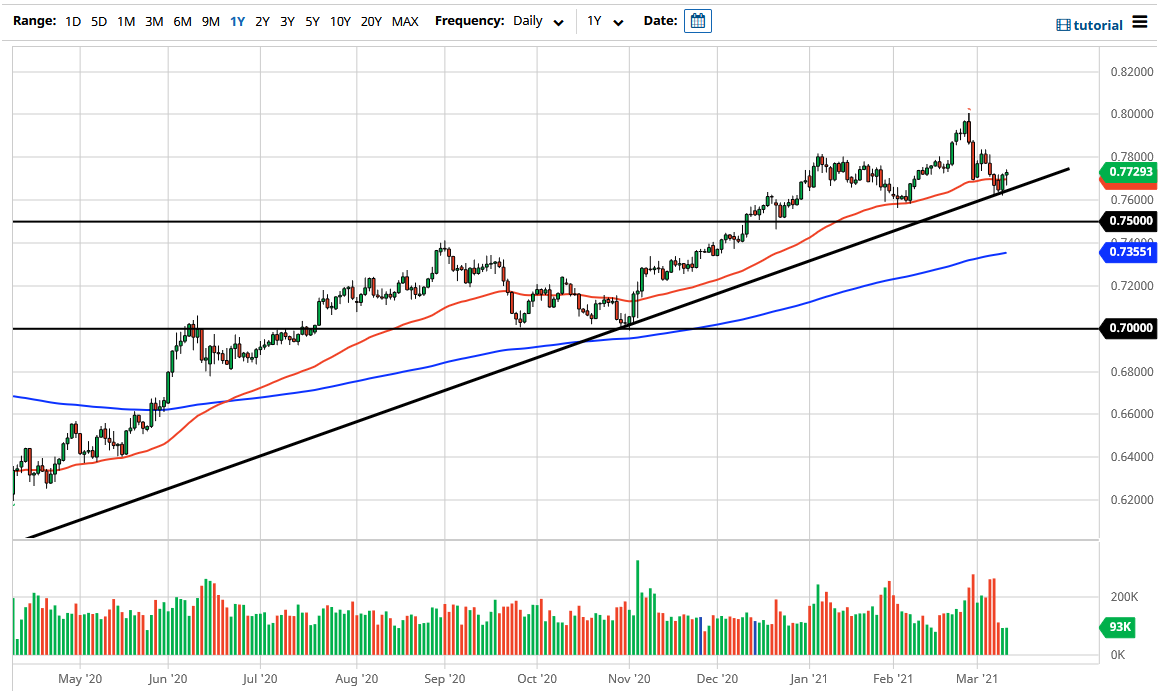

The Australian dollar has pulled back just a bit during the trading session on Wednesday but then found support just below the 50 day EMA. That being the case, the market is likely to continue to go higher, based upon not only the 50 day EMA but the fact that the yields in America are finally dropping again. We have bounced from a major uptrend line, and now it looks like the Aussie is going to go looking towards the 0.78 level. At this point, if we can break above there, then it is likely that the market is going to go looking towards the 0.80 level, which is a massive resistance barrier on longer-term charts and an area where we had previously pulled back from.

I do not necessarily think that the Aussie simply shoot straight up in the air, but for me I believe that it is only a matter of time before buyers come back in and push this market higher. The 0.80 level was an area that longer-term traders were paying close attention to and I think that if we can clear the area between there and 0.81, this market can go much higher. In fact, when you look at the monthly charts, you can see that if the market were to break above the 0.81 handle, it is very likely that we could go all the way to the 0.88 level. After that, the next target would be the 0.90 level.

On the other hand, we do turn around a break down we could see a bit of support at that uptrend line, and then the 0.75 level. If we were to turn around a break down below the 0.75 handle, it would kick off a massive selloff, due to the fact that it would confirm a massive shooting star from the February timeframe. That being said, most of the selling was done in a couple of rough days at the end of the month, and due to the yields spiking in America. In other words, it is possible that the fundamentals are changing back to a more positive situation as people start to play the “reflation trade” yet again. Commodities continue to be a focus by a lot of people out there with the idea of inflation being an issue, and therefore the Aussie could continue to be a beneficiary.