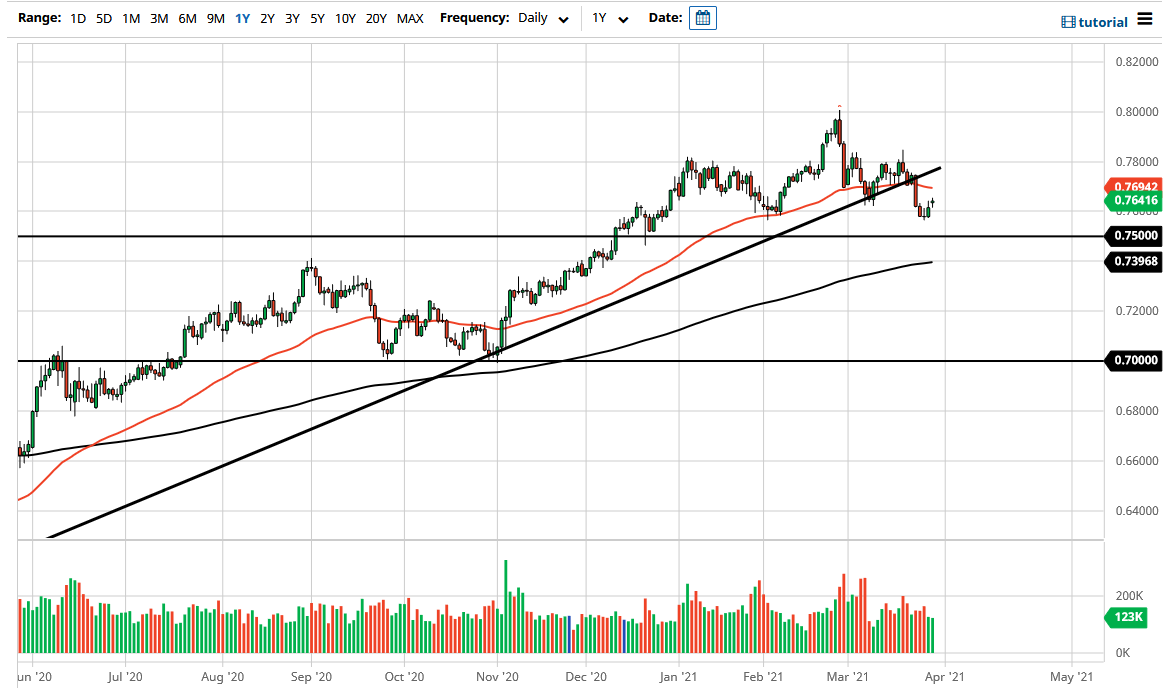

The Australian dollar gapped higher to kick off the Monday session, but then went back and forth to form a less than impressive candlestick. While there is not too much you can be reading into this particular candle, once worth noting is that we are starting to see the 50 day EMA rollover and turned lower in the Aussie, and from a technical analysis standpoint that could be a bit of an issue. With that being said, I think this is a market that will eventually have to make a bigger decision, and right now it looks as if that decision might be for negativity. If that is the case, I think it would not take much imagination to see this market go down to the 0.75 handle.

Once we get beyond that, the next target would be the 200 day EMA, currently trading right around the 0.74 handle. This of course is a highly followed technical indicator, but I think at this point it would only be a hiccup on the way down to much lower levels based upon the fact that we would have kicked off a move lower based upon a head and shoulders pattern. That of course is a widely followed pattern, and one should keep in mind that the Australian dollar did of course form a massive shooting star for the February candlestick, so that in and of itself is probably something worth paying attention to.

Furthermore, China and Australia are starting to get tit for tat when it comes to chirping at each other in public, as the Chinese have now levered a five-year tariff on Australian wines. While this in and of itself is not enough to put a huge dent into the Australian economy, it is just the latest in what has been a souring of relations between Beijing and Canberra. Beyond that, we have seen overall US dollar strength, and that of course will show itself in this market just like it would any other one. At this point, I am looking for selling opportunities until we do something like close on a daily candlestick above the 50 day EMA. At this point, the Australian dollar has bounced ever so slightly from minor support underneath, but it has been lackluster to say the least.