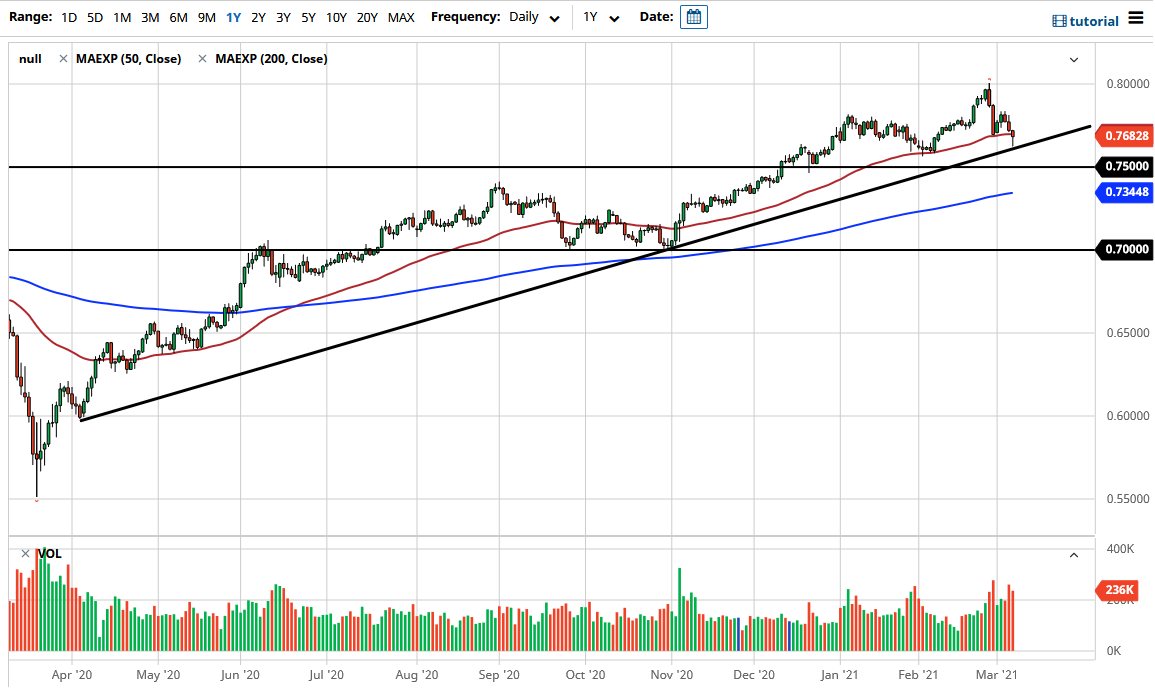

The Australian dollar got hammered after the jobs number came out and did start selling off before the jobs in the air even came out. Ultimately, the market has reached down towards the uptrend line, which is a major one from a longer-term standpoint. Furthermore, the 50 day EMA is sitting in the middle of the candlestick, but that should offer support given enough time. All things being equal, the market has formed a hammer and that does suggest the idea of a pop higher. If we can break above the highs from the Friday session, then we will more than likely go looking towards the 0.78 handle, before we get to that 0.80 level.

The biggest thing about the 0.80 level is that it is the beginning of significant resistance that extends 100 points. If and when we can break above the 0.81 handle, the market is likely to go much higher, in more of a “buy-and-hold” type of attitude. After all, if you look at the monthly chart, when we broke above the 0.81 level in the past, we always went much higher. I think we are pulling back the way we have simply to build up the necessary momentum to try and take out the barrier above. It was probably a bit much to ask this market to simply slice through it like it was no big deal.

On the other hand, we could break down below the uptrend line, which could send this market down to the 0.75 handle. The 0.75 handle of course is a large, round, psychologically significant figure, and then after that we have the 200 day EMA that is currently sitting just around the 0.7350 level. If we get below there, then the Australian dollar is likely to go much lower. Keep in mind that the February candlestick was a massive shooting star, so that of course is a negative sign. Because of this, this is a market that has to make a pretty big decision rather soon, and I think it is going to be a huge trade just waiting to happen. Be cautious about your position size, because this is going to get erratic but so far, we are still trying to grind to the upside so one has to assume that we are more likely to go higher than lower.