Bearish View

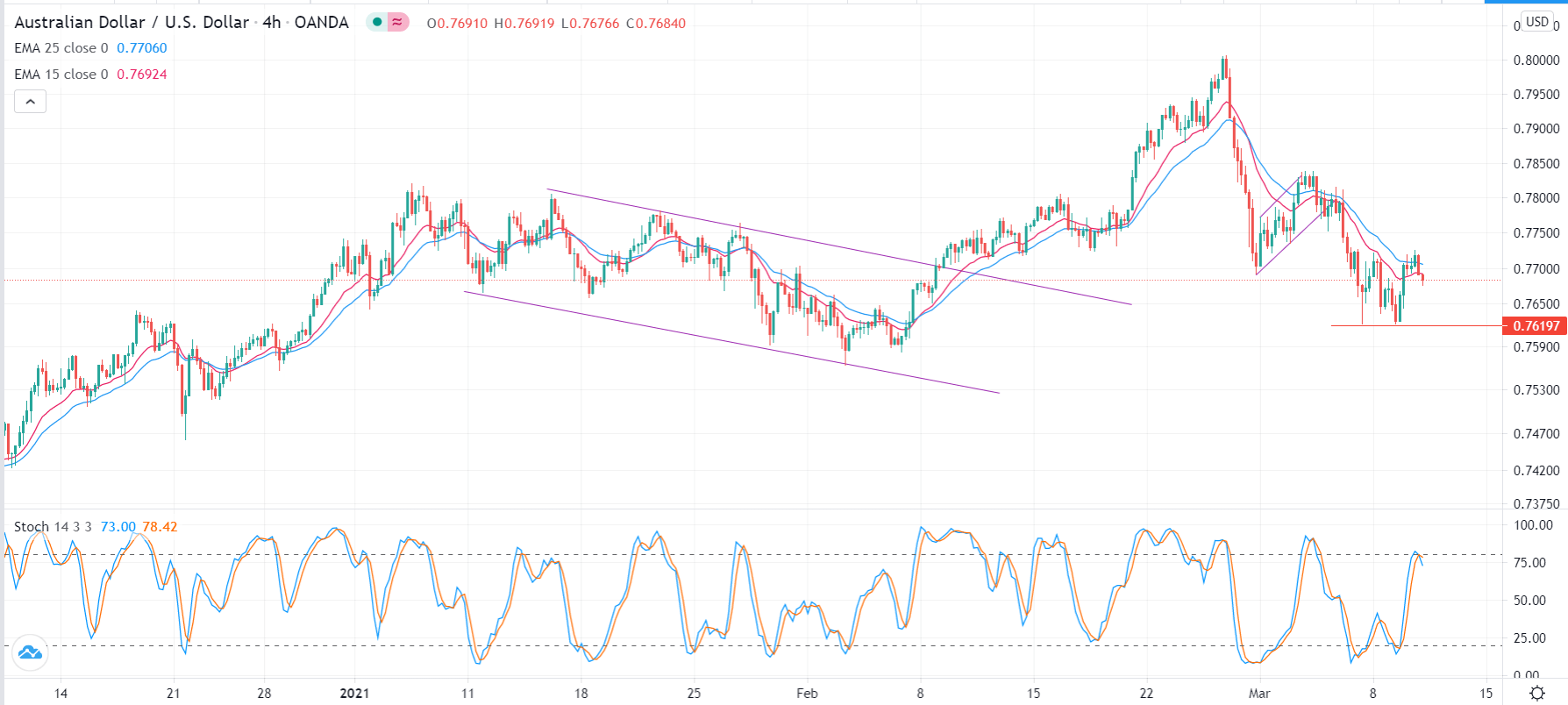

Sell the AUD/USD and add a take-profit at 0.7620.

Add a stop-loss at 0.7780.

Bullish View

Set a buy stop at 0.7780 and a take-profit at 0.7900.

Add a stop-loss at 0.7700.

The AUD/USD price downward trend continued ahead after relatively dovish comments by RBA Governor Philip Lowe. It is trading at 0.7685, which is 4% below the year-to-date high of 0.800.

Australian Dollar Pressured

After a solid start to the year, the Australian dollar has been under intense pressure in the past few days. This performance is mostly because of the overall strong US dollar as the US bond sell-off accelerates. For one, the benchmark 10-year yield is trading at the highest level in more than 12 months.

The AUD/USD has also dropped because of the overall weakness of commodities. In the past few days, the Bloomberg Commodities Index (BCOM) has declined from almost $87 to the current $84.

Indeed, today, the price of iron ore declined by 6% to $U164 a tonne as investors started to grow concerned about Chinese demand. Other commodity prices that have tumbled are copper, crude oil, and silver. The Australian dollar is often viewed as a proxy for commodities because of the vast resources it exports every year.

The AUD/USD is also falling after comments by Philip Lowe, the RBA governor. Addressing the Australian Financial Review Business Summit, the governor lamented that wage growth was significantly weak for the bank to move from its ultra-loose monetary policy. This statement is relatively at odds with the bond market. Like in the US, yields on Australian government bonds have been rising recently.

Later today, the AUD/USD will react to the latest US inflation numbers. The general outlook is that consumer prices rose in February because of the high commodity prices and the last stimulus. Therefore, with the US about to implement another record $1.9 trillion stimulus package, there is a possibility that this trend will continue.

AUD/USD Technical Outlook

The AUD/USD pair has been on a sharp downward trend in the past few days. On the four-hour chart, the pair has moved below the 25-period and 15-period exponential moving averages (EMA). It has also formed a double bottom pattern at the 0.7620 level while the two lines of the Stochastic oscillator have continued to drop. Therefore, there is a possibility that the pair will decline as bears attempt to retest the important support at 0.7620.