Last Thursday’s AUD/USD signals were not triggered, as none of the key levels identified were reached that day.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered prior to 5pm Tokyo time Wednesday.

Short Trade Ideas

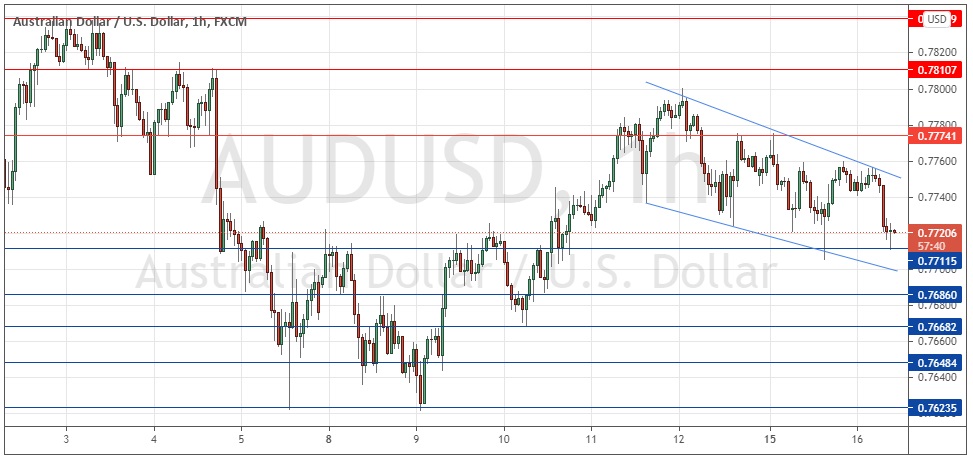

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7774, 0.7811, or 0.7839.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7711, 0.7686, 0.7668, or 0.7648.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that the recent bullish movement from the breakout was strong and firm and the price looked likely to reach at least as high as 0.7811, so I took a cautious bullish bias right away.

This was a good call as the price rose over the day after an initial fall, reaching the round number at 0.7800 and closing the day well up.

The picture now is messy and borderline bearish, with the price having retreated as the U.S. dollar has continued its advance by some amount. What is most interesting is that while risk-on sentiment is still present and reasonably healthy, it seems to have come uncoupled from the Aussie, suggesting that the Australian dollar is subtly losing its strength.

Turning to a more practical technical interpretation, we see the price moving down slowly within a medium-term bearish price channel, but at present the support level at 0.7711 seems to be holding up.

I think the price is likely to remain within the channel between 0.7711 and 0.7774 over the coming hours, so a long trade from this bounce at 0.7711 carefully monitored on a short time frame is likely to be the best opportunity which might arise in this currency pair today.

Regarding the USD, there will be a release of retail sales data at 12:30pm London time. Regarding the AUD, the Deputy Governor of the Reserve Bank of Australia will be giving a minor speech at 11:30pm.