Bullish View

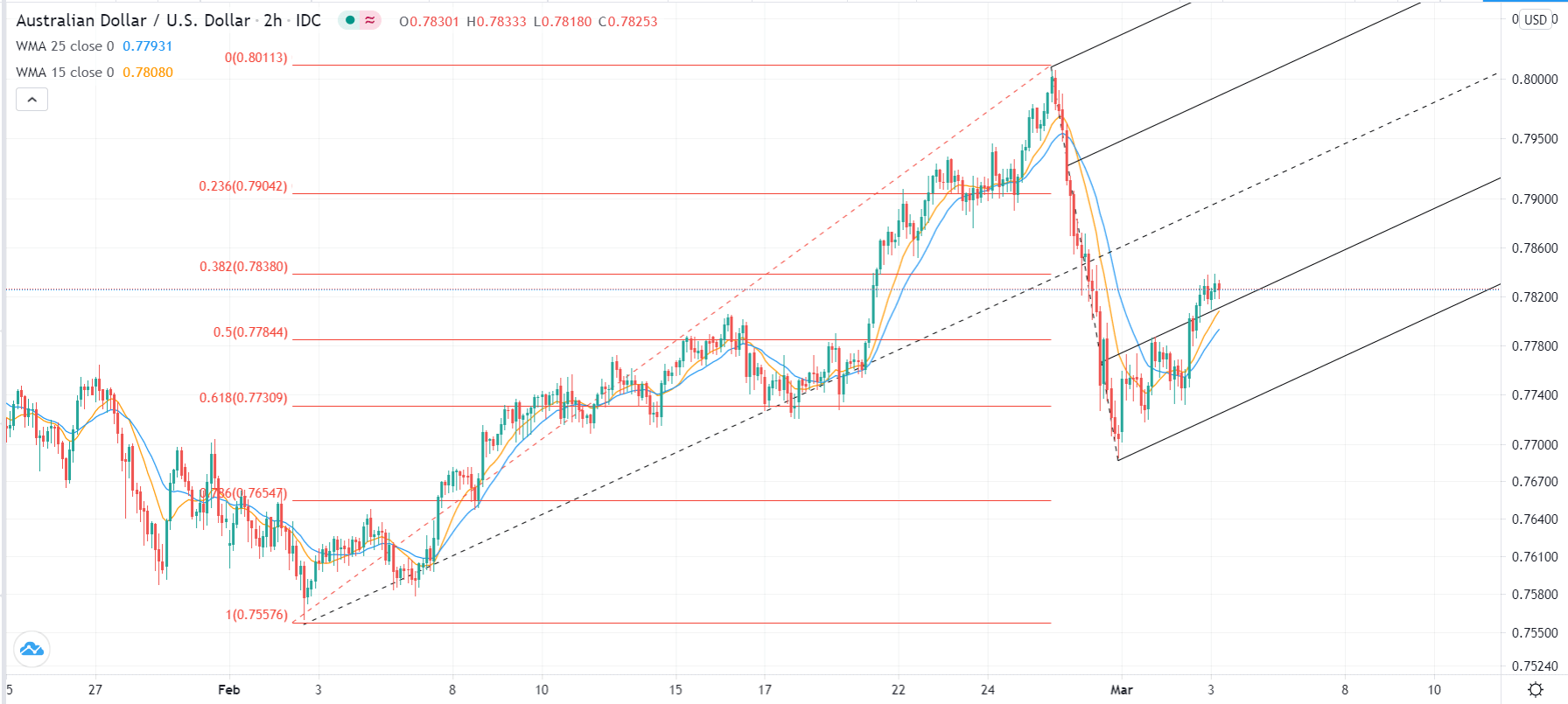

Set a buy stop at 0.7850 (slightly above the 38.2% retracement).

Add a take profit at 0.7900 (pitchfork median).

Set a stop loss at 0.7800.

Bearish View

Set a sell stop at 0.7800 and a take profit at 0.7750.

Add a stop loss at 0.7850.

Timeline: 1-2 days.

The AUD/USD price rose in early trading as the market reacted to the latest Australian GDP and Service PMI data. It is trading at 0.7827, which is almost 2% above last week’s low of 0.7688.

Australian Economy Recovery

The Australian economy is inching closer to full recovery, according to the latest data by the Statistics Bureau. In total, the economy rose by 3.1% in the fourth quarter after rising by 3.4% in the third quarter. This recovery was better than the median estimate of 2.5%. However, because of the pandemic, the economy declined by 1.1% from the same period in 2019.

The bureau attributed the strong performance to the increasing household spending and private investments. The two rose by 4.3% and 3.9%, respectively. They were greatly affected by the lockdowns in Victoria to curb the virus. Compensation increased by 1.5% while the agricultural sector rebounded.

The AUD/USD is also rising after the relatively strong Australian Service PMI data. According to Markit, the PMI dropped to 53.4 in February from 55.6 in the previous month. It was also the lowest reading since September. Still, it is a sign that business activity is improving since it was above 50. Notably, business sentiment increased to the highest level in two-and-a-half years.

These numbers came a day after the Reserve Bank of Australia (RBA) delivered its second interest rate decision of the year. The bank, as expected, left interest rate and quantitative easing policies intact and pledged to do more.

Later today, the AUDUSD will react to the latest Service PMI data from the United States and the private non-farm payroll numbers by ADP.

AUD/USD Technical Outlook

The two-hour chart shows that the AUD/USD has bounced back from last week’s low of 0.7688. The price has also moved above the first support of the Andrews pitchfork tool and is slightly below the 38.2% Fibonacci retracement level.

The 15-period and 25-period weighted moving averages (WMA) have also made a bullish crossover pattern. The pair is also forming a small bullish flag pattern. Therefore, the pair may continue rising as bulls target the median of the pitchfork tool at 0.7900.