Bullish Case

Place a buy stop at 0.7773 (today’s high).

Add a take profit at 0.7850 and a stop loss at 0.7720.

Bearish Case

Place a sell-stop at 0.7720 and a take profit at 0.7680.

Add a stop loss at 0.7773.

The AUD/USD pulled back in early trading as the market reflected on the latest Manufacturing PMI data from China and Australia and the retreating US Treasury yields. The pair is trading at 0.7762, which is slightly above last Friday's low of 0.7693.

Australian Dollar Bounces Back

The AUD/USD is rising after the latest manufacturing data from Australia and China. In general, the Chinese Manufacturing PMI declined in January because of the week-long lunar New Year celebration. Data by the National Bureau of Statistics showed that the PMI dropped to 50.6, while that from Markit showed that the PMI fell from 51.5 to 50.9. A PMI figure of 50 and above is usually a sign of expansion.

Meanwhile, in Australia, the Manufacturing PMI increased from 55.3 to 58.8, according to the Australia Industry Group (AIG). This is a sign that the country’s economy is rebounding even as the two countries go through a trade conflict.

Further data revealed that the Australian business inventories rose from - 0.3% in the third quarter to 0.0% in Q4. This increase was slightly below the median estimate of 0.2%. Also, data by ANZ showed that job adverts rose by 7.2% in January from 2.6% in the previous month. This is another sign that the business environment is improving in Australia.

The AUD/USD is rising today even after the US Treasury yields declined slightly today. The yield on the 10-year declined from last week’s high of 1.5% to 1.49%. This happened even after the House of Representatives passed the $1.9 trillion stimulus package. This week, traders will be watching the statements from key important senators like Joe Manchin of West Virginia and Susan Collins of Maine.

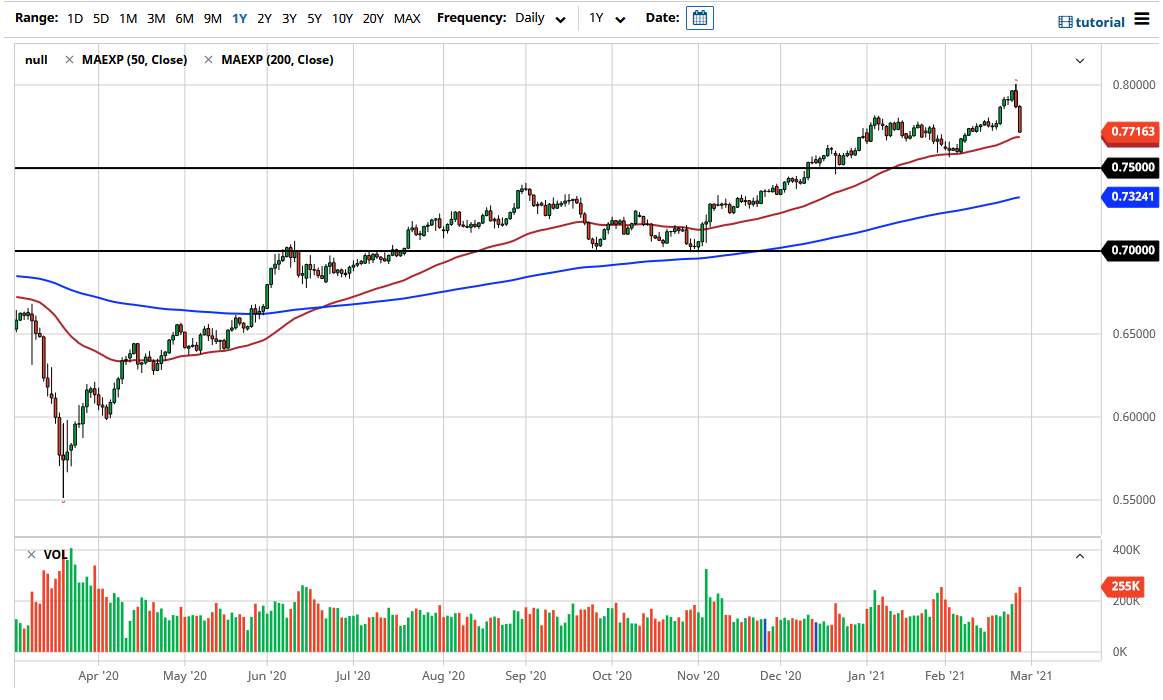

AUD/USD Technical Outlook

On Friday, the AUD/USD pair dropped to 0.7690, the lowest level since February 8. Today, the pair has jumped by almost 1% as investors watch the action on US yields. On the hourly chart, the price has moved above the important resistance at 0.7720. It has also moved above the 15-period exponential moving average and the 78.6% Fibonacci retracement.

Therefore, the key levels to watch today will be the intraday high of 0.7772. A move above this level will mean that bulls are in control, which will push it to the next psychological level of 0.7800. The other level will be 0.7720. A drop below the level will see it retest the lowest level last week.