Bearish View

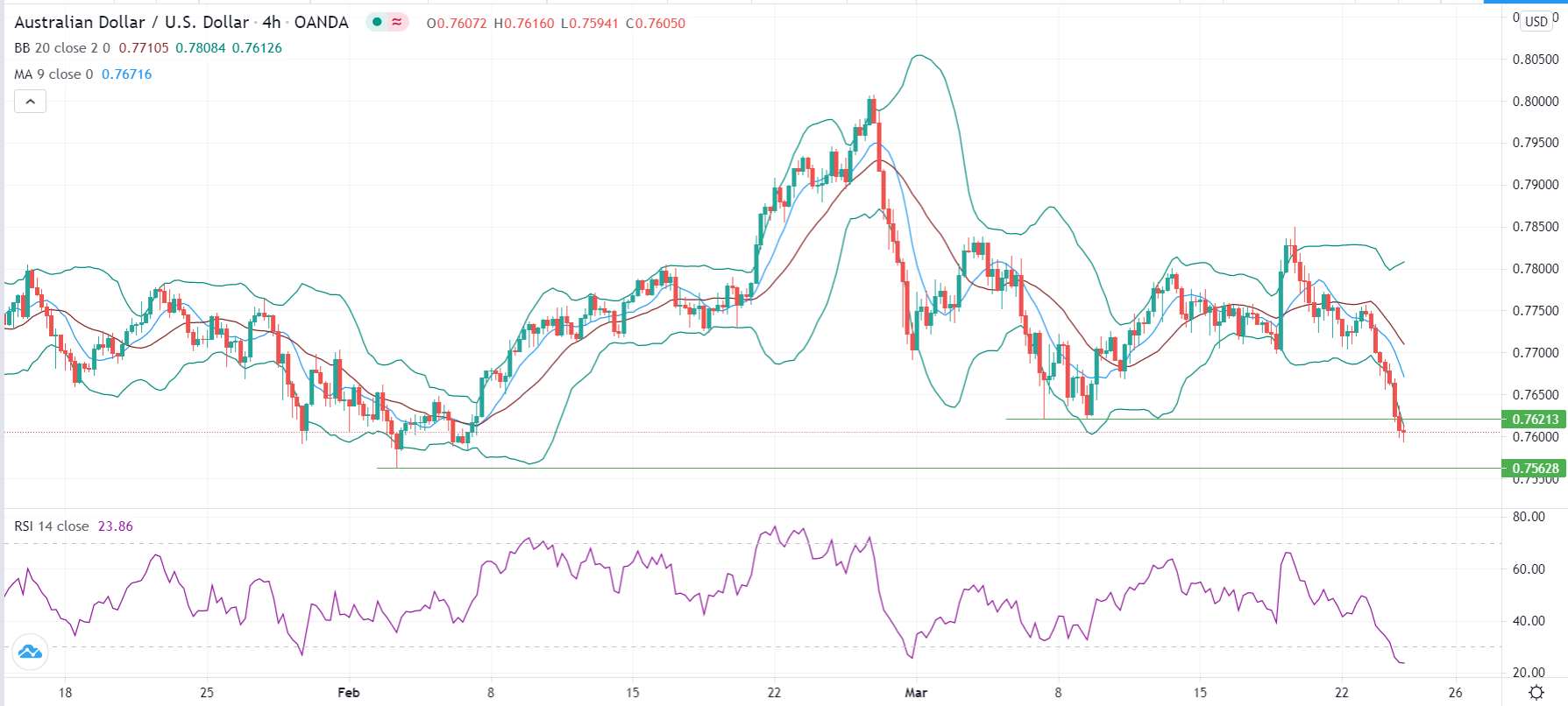

Sell the AUD/USD and set a take-profit at 0.7562.

Add a stop-loss at 0.7650.

Timeline: 1 day.

The AUD/USD price declined sharply in the evening session as traders reacted to the relatively weak commodity prices and the stronger US dollar. It is trading at 0.7600, which was the lowest level since February 20th this year.

US Dollar Steady

The US dollar has been relatively strong this week. The closely-watched US Dollar Index has risen for the past three days as US Treasury yields ease. After rising to a 14-month high of 1.74% last week, the yield of the ten-year government bonds dropped to 1.59% in the Asian session. Similarly, the 30-year yield has dropped to 2.29%. In Australia, the yield of the ten-year yield dropped to 1.64%

This performance came as the fears of high inflation eased substantially in the past few days. For one, the Federal Reserve has reiterated several times that it will not hike interest rates in the near term. In a testimony yesterday, he said that the central bank would continue to support the economy through low interest rates and quantitative easing since the recovery was relatively uneven.

The AUD/USD declined even after the relatively strong flash Manufacturing and Services PMI numbers. According to Markit, the country’s Manufacturing PMI increased from 56.9 in February to 57.0 in March as demand rose. Similarly, the country’s reopening pushed the Services PMI from 53.4 to 56.2. A PMI reading of 50 and above is usually a sign of growth.

The sluggish commodities sector has had a negative impact on the Australian dollar. The Bloomberg Commodities Index has dropped by more than 0.20% today. It has fallen for the past three consecutive days because of the overall stronger US dollar and worries of more demand. However, a proposed $3 trillion infrastructure package in the United States will likely lead to more demand for key commodities like iron ore and copper.

AUD/USD Technical Forecast

The four-hour chart shows that the AUD/USD has dropped for the past 9 consecutive four hours. It has also moved below the important support level at 0.7620. The pair has also dropped below the 25-day moving averages and is along the lower line of the Bollinger Bands. The Relative Strength Index (RSI) has dropped to the lowest level in months. Therefore, the pair may keep falling as bears target the next key support level at 0.0.7560. However, a move above 0.7650 will invalidate this trend.