Last Tuesday’s AUD/USD signals were not triggered, as none of the key levels identified were reached that day.

Today’s AUD/USD Signals

Risk 0.75%.

Trades may only be taken before 5pm Tokyo time Thursday.

Short Trade Ideas

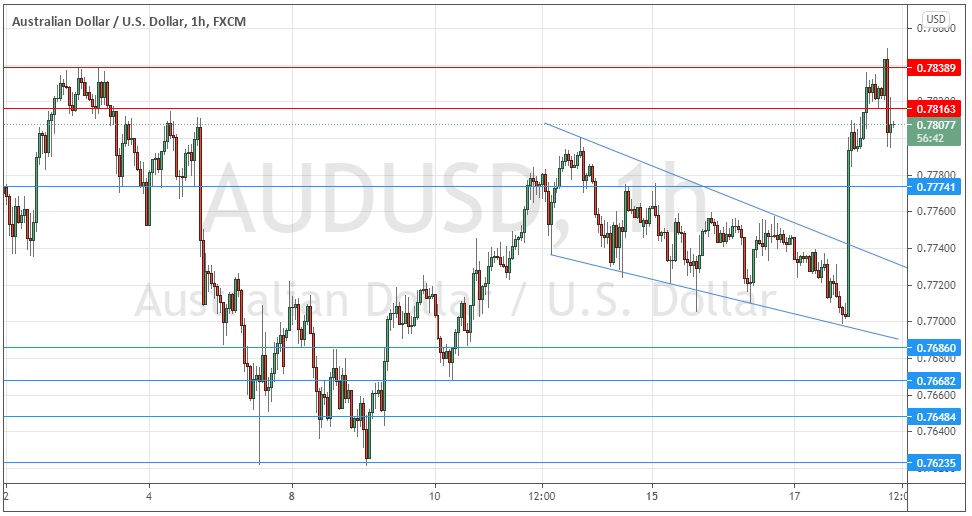

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7816, 0.7839, or 0.7884.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7793, 0.7774, or 0.7686.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that the price was likely to remain within the channel between 0.7711 and 0.7774 over the coming hours, so a long trade from this bounce at 0.7711 carefully monitored on a short time frame would probably be the best opportunity which might arise today.

This was an accurate call as the price did remain within that range over the net 24 hours, but it was not very useful as instead of retracing and rebounding at 0.7711 quickly, the level was not even reached over the day.

The technical picture now is more bullish. Last night’s FOMC release had the effect of pushing down the value of the U.S. dollar to a meaningful low, with the USDX (U.S. Dollar Index) reaching a 2-week low price. Almost every currency gained firmly against the USD and the AUD was arguably the top gainer, boosted perhaps over recent hours by a release of much stronger than expected Australian employment data.

Technically, the dominant chart pattern is like what we see in EUR/USD, but more bullish as the recent swing high exceeded the previous significant inflective high at 0.7839 by a few pips.

I see the outlook as bullish here provided the support levels hold, especially the support at 0.7793 which has just been touched and is holding – this is probably going to be today’s pivotal point, the question for bulls is just whether the price can get above the two resistance levels at 0.7816 and 0.7839 – I will be surprised if the price settles above 0.7839 today so the short-term upside may be limited.

There is nothing of high importance due today regarding either the AUD or the USD.