Today’s AUD/USD Signals

Risk 0.75%.

Trades may only be taken before 5pm Tokyo time Wednesday.

Short Trade Ideas

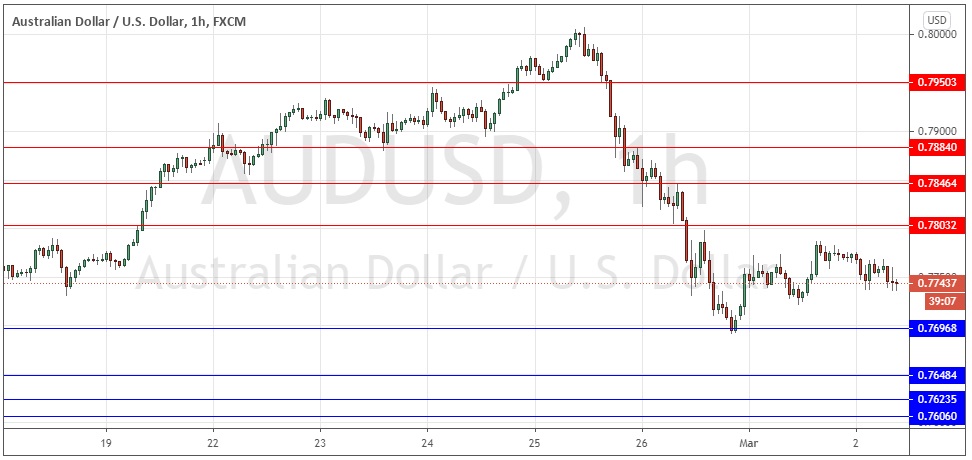

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7804 or 0.7846.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7697, 0.7648, or 0.7624.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

The Australian dollar has been hit quite hard over the past week after reaching a near 3-year high price very close to the significant round number at 0.8000, since risk-on sentiment was shaken by rising U.S. Treasury yields, which exceeded the significant level of 1.5% per year. There has been recently a quite strong positive correlation between the performance of the Australian dollar and major stock market indices. Yet, although we have seen stocks bounce back somewhat, the Australian dollar has been trading sideways over the past couple of days.

Nevertheless, there is hope for bulls, provided the price can hold up above the support level at 0.7697, which is probably made stronger due to its confluence with the round number at 0.7700. The consolidation pattern we are seeing now below 0.7800 seems to slightly favour bulls as we have higher lows.

I think the best approach here would be ready to take a long trade, especially on a short time frame, from any bullish bounce at 0.7700, but I will not be content to take a fully bullish bias here until the price gets established above 0.7800, which looks likely to be today’s pivotal point. A failure at the resistance level there could alternatively provide an attractive opportunity to enter a short trade.

The best time to enter a trade in this currency pair is likely to be just after the Australian GDP data release later, so if the setup arrives at this time, you can probably have more confidence in it.

Concerning the AUD, there will be a release of Australian GDP data at 12:30am London time. There is nothing of high impoportance due today regarding the USD.