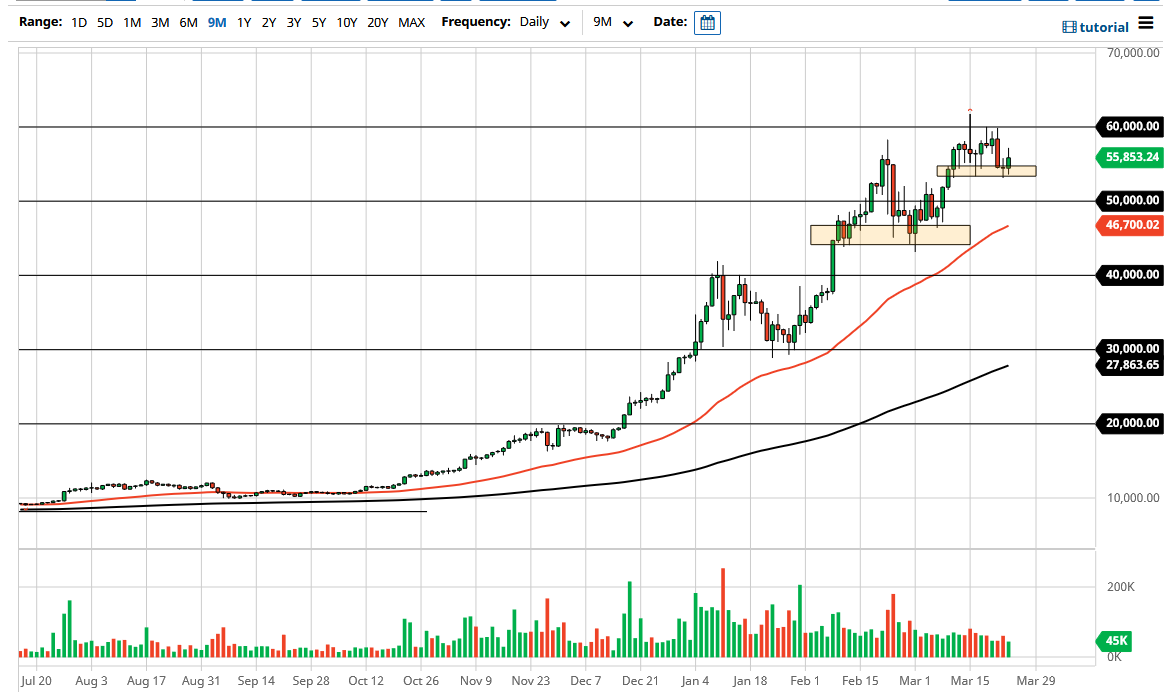

Bitcoin initially pulled back just a bit during the trading session on Wednesday to test the support level underneath, and then turned around to show signs of strength yet again. Currently, the market looks as if it is in a relatively tight range, perhaps reaching a $5000 total. The $55,000 level has offered significant support, just as the $60,000 level has offered significant resistance. If we can break above that level, then the market goes much higher, perhaps reaching towards the $65,000 level, maybe even the $70,000 level after that.

To the downside, if we were to break down below the lows of the last couple of days, then it is possible that we would go looking towards the $50,000 level, but that is an area that will be massive in its support, so I think breaking down below there would be very difficult. If we did, then next barrier of course would be the 50 day EMA that looks very strong. With all this being said, I think that any time we pull back it is going to be thought of as value, as Bitcoin has been in such a bullish run for so long.

The crypto currency markets have been strong for quite some time, and of course Bitcoin is going to be the leader. That being said, I do think that there is a certain amount of money flowing into other coins at the same time, and therefore it may be taking a little bit of the momentum out of this market but one of the major changes that we have seen recently has been institutional money entering the picture, which of course changes the overall attitude. After all, it is very unlike institutional money to simply freak out and start selling at the first dip, so all things being equal I think that there will be plenty of buyers willing to step in and pick this up.

I think most institutional money will be looking at pullbacks as potential value, just as a lot of the true believers have been. At this point, the 50 day EMA underneath has offered quite a bit of dynamic support, and of course has offered a bit of a trend line as well, so I think that is about as low as we can go on any pullback in the short term. I still favor the upside regardless.