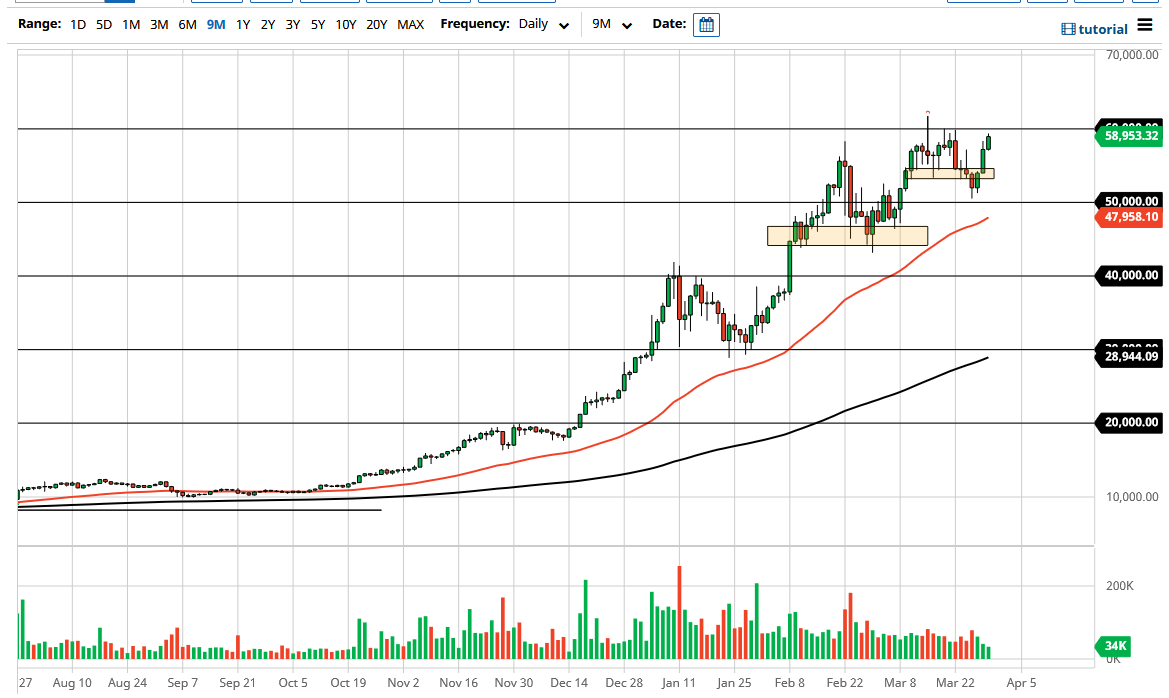

Bitcoin markets rallied again during the trading session on Tuesday to reach towards the $60,000 level. This is an area that of course is a large, round, psychologically significant figure, and therefore it will probably attract a lot of attention. That being said, I do think it is only a matter of time before we break out above there as the whole world wants to pile into Bitcoin at the moment. Beyond that, institutional investors continue to pile into the market as well, and as there are concerns around the world right now as far as contagion is concerned, due to the recent hedge fund meltdown, Bitcoin continues to attract attention.

If and when we break above the $60,000 level, it is very likely that we will go looking towards the $62,500 level, and then eventually the $65,000 level. In the meantime, pullbacks will be thought of as potential buying opportunities just as they have for several months now. There is really no argument for shorting this market, even though it has been extraordinarily bullish for ages.

The one thing that I can say the in a negative light is that we are clearly running out of momentum, but that might not necessarily be the end of the world as market can sometimes get far too ahead of itself. Bitcoin has been susceptible to major meltdowns after going parabolic, so if we can spend some time chopping back and forth it will certainly be a good thing. That being said, I do not necessarily expect to see any type or breakdown, so I continue to look at these dips as opportunities to get long in a market that is extraordinarily bullish.

What is especially impressive is that the Bitcoin market is managing to rally the way it is in the face of a strengthening US dollar. In that sense, perhaps the Bitcoin market is starting to mature even further, as it is no longer simply a “way to get away from the greenback.” Further decoupling from other markets is a good sign, because looking at this market, it is also worth noting that gold has been falling apart at the same time. In other words, it is not “digital gold”, it is becoming something much different over the longer term. No matter what it will end up being, this is a market that is bullish about, so you need to pay attention to.