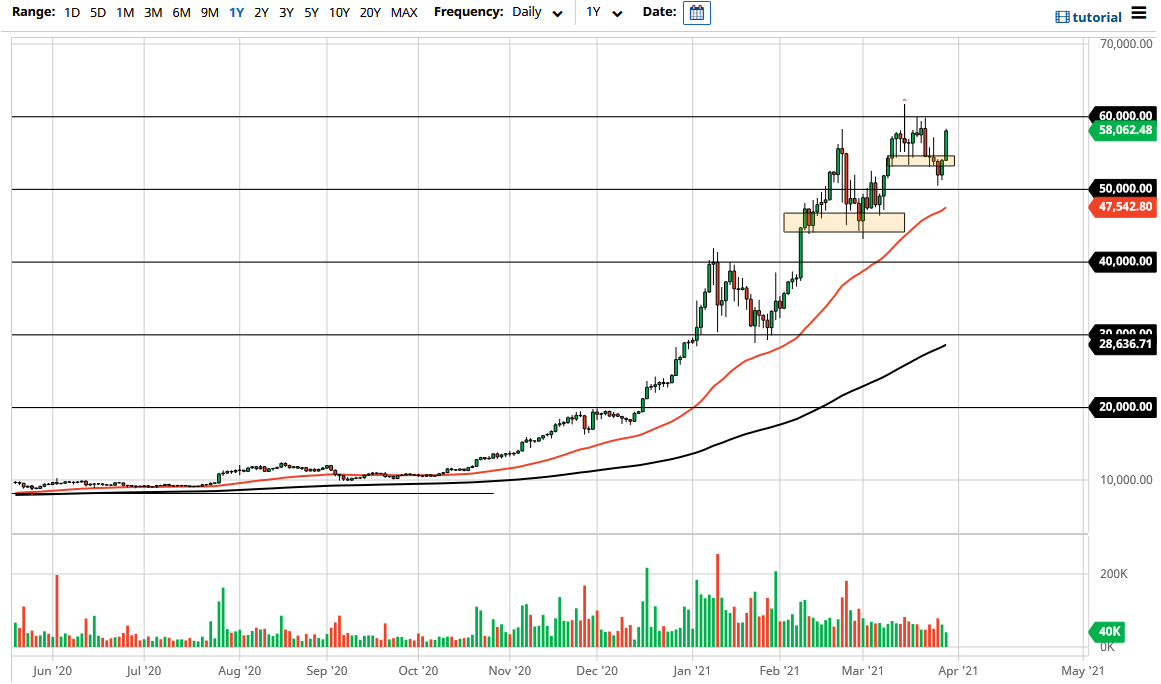

Bitcoin markets have rallied quite significantly during the trading session on Monday as traders came back to work. The $55,000 level was sliced through, as Bitcoin is now threatening the $58,000 level again. Just above though, the $60,000 level comes into the picture, an area that has been massive resistance recently. I do think that eventually we will break through there, and the candlestick on Monday certainly add some credence to that.

Whether or not we can break above the $60,000 level right away is a completely different question of course, but at this point it seems as if we are going to continue to try to get there. If we can break above the $60,000 level, then it is likely that we will go looking towards the $65,000 level based upon the fact that the market seems to step back and forth in $5000 increments.

A pullback, we could see the $50,000 level come into the picture, as it is a large, round, psychologically significant figure that will attract a lot of attention, and it is also where we are starting to see the 50 day EMA reach towards. After that, then the next potential buying opportunity is closer to the $45,000 level.

I do not have any interest in trying to short this market, because there is far too much institutional money coming in and of course we have seen a lot of interest for retail traders as well. Furthermore, there have been a lot of concerns in the financial markets abound yield, so in a world that there is so much uncertainty, a lot of money is starting to come into the crypto currency markets and use Bitcoin as a place to park money. Longer-term, the market is expected to go towards the $100,000 level, and even higher than that. With that in mind, a lot of Bitcoin investors are just that, investors. They are not trading it and end up holding onto it for a long time. This makes the market more bullish anyway, so I think all things being equal, it is only a matter of time before we do break out. In fact, it is not until we break down below $40,000 that I would be concerned about the uptrend, and even then, I think it will only be a matter of time before value hunters would come back.