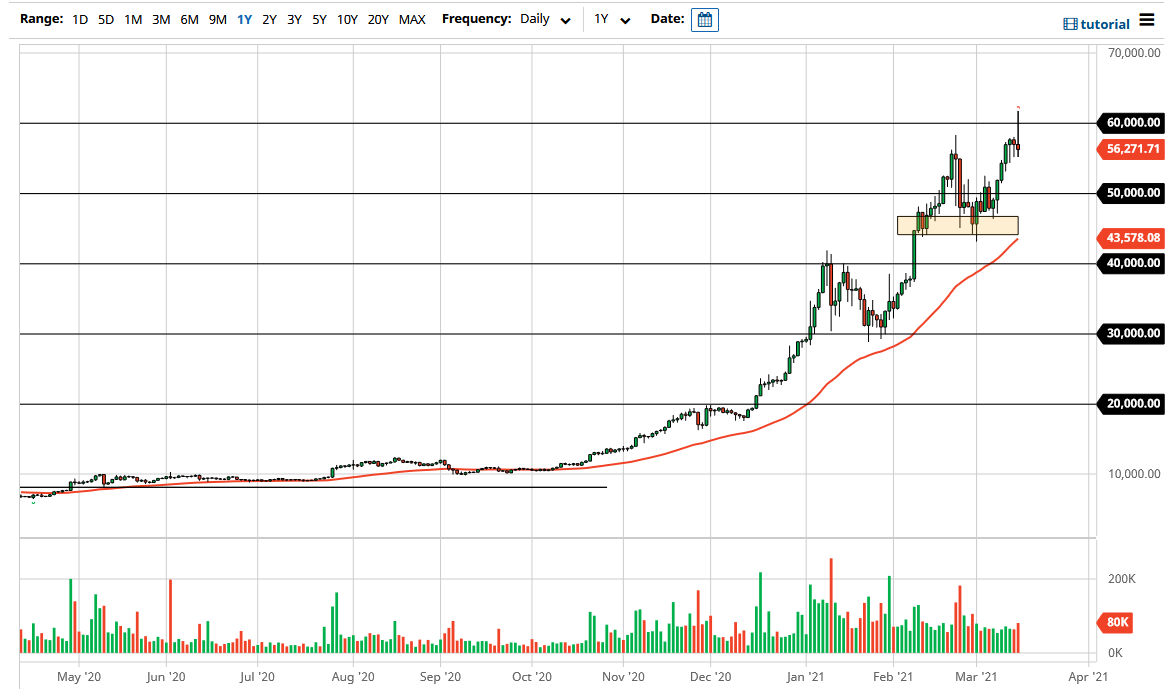

Bitcoin markets have been all over the place during the trading session on Monday, breaking well above the $60,000 level only to turn things around and show signs of exhaustion. Ultimately, this is a massive shooting star and that in and of itself is technically a major reversal candle. This is especially true considering how large the range of the candlestick is. That is not necessarily a suggestion that you should be selling this market, just that we are obviously going to see a bit of a fight at the $60,000 level, and that we are not simply going to slice right through it.

If we were to break down below the lows of the last three candlesticks, it would kick off a bit of a selling signal, but at this point I think you have to look at it more or less through the lens of a pullback rather than a shorting opportunity. The pullback probably opens up the possibility of a move down to the $50,000 level, maybe even as low as $45,000. At the $45,000 level, we have seen a significant amount of support come into play, and now we have the 50 day EMA reaching towards that level as well. In other words, it is a great area of confluence that we could see a lot of action at.

On the other hand, if we were to turn around a break above the top of the candlestick for Monday, that would be a major violation of resistance, and therefore probably kick off some type of “blow off top” for the interim. Do not get me wrong, I am not necessarily suggesting that we are ready to reverse the trend, but the reality is we have seen a massive move higher, and a lot of traders will be out there looking for some type of value before getting involved. This is especially true when you think through the prism of an institutional investor. Institutions do not want to pay at extreme highs for any asset, let alone an unproven one like Bitcoin. In a sense, that will keep the market from going parabolic, but at the same time it also provides a bit of a “floor the market” on these dips, so I think if you are patient enough you should be able to get better pricing.