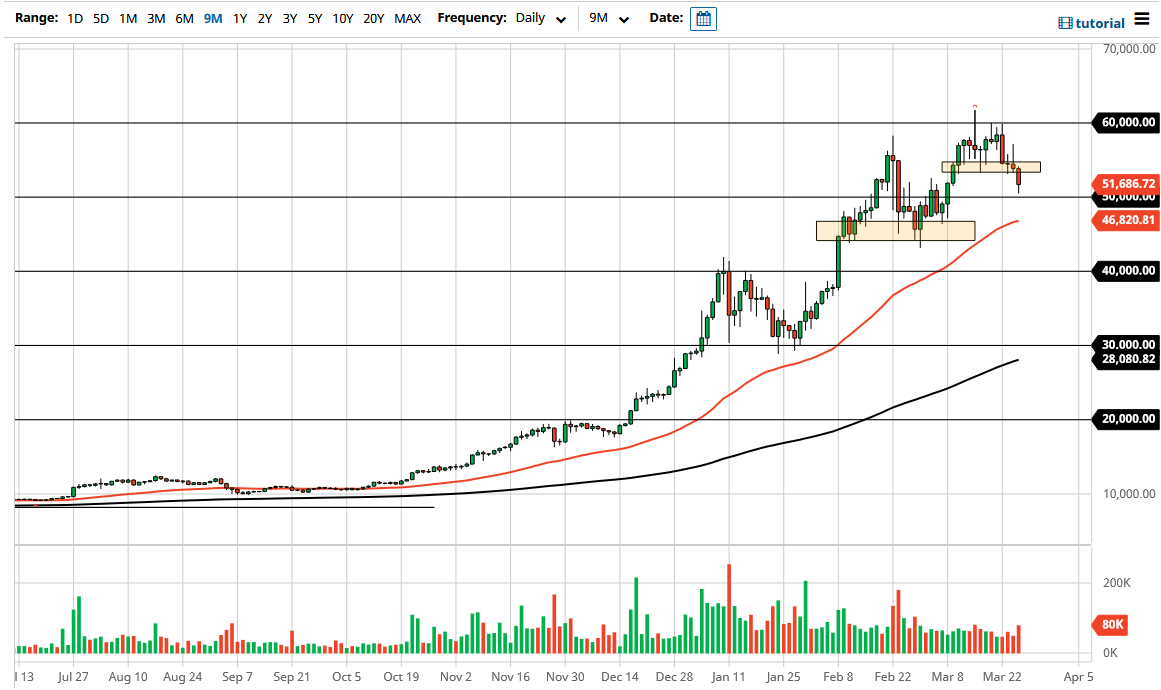

Bitcoin markets fell during the trading session on Thursday to reach all the way down towards the $50,000 level. The $50,000 level is an obvious psychological level that a lot of people that would pay close attention to, and therefore it does make sense that the market turned around in that general vicinity. That being said, we are seen a lot of US dollar strength and it finally showed itself in the crypto markets.

It is interesting that we have seen crypto strength in the face of the US dollar strength until the Thursday session, but at the end of the day the correlation is still relatively unclear, mainly due to the fact that the crypto markets do not have a lot of history that we can draw upon. Regardless, this is a market that is still very much in an uptrend, and you have to look at it through that prism as the market has been so strong over the last several months.

If we do rally from here, the market is probably going to go looking towards the $55,000 level, an area that has been both support and resistance recently. A break above that level then opens up the possibility of Bitcoin reaching towards the $60,000 level. That area has been very resistant as of late, and therefore think it is going to take quite a bit of effort to finally get above there. If we do, then it allows the market to go much higher. However, I think we are much more likely to go back and forth in the short term, and I certainly do not think that the trend is changing. The 50 day EMA sits at the 46,800 level, so that is another area that I think a lot of people would be interested in.

The market continues to make “higher highs” and “higher lows.” That is the very definition of an uptrend, so I am only looking to get long at this market. In fact, it is not until we break down below the $40,000 level that I would be concerned about the overall health of the trend, and clearly with so much institutional money coming into the marketplace, it is difficult to imagine that we are going to break down for a bigger move. As these institutions get involved, they will look at these pullbacks as potential value and will be more than willing to take advantage of them.