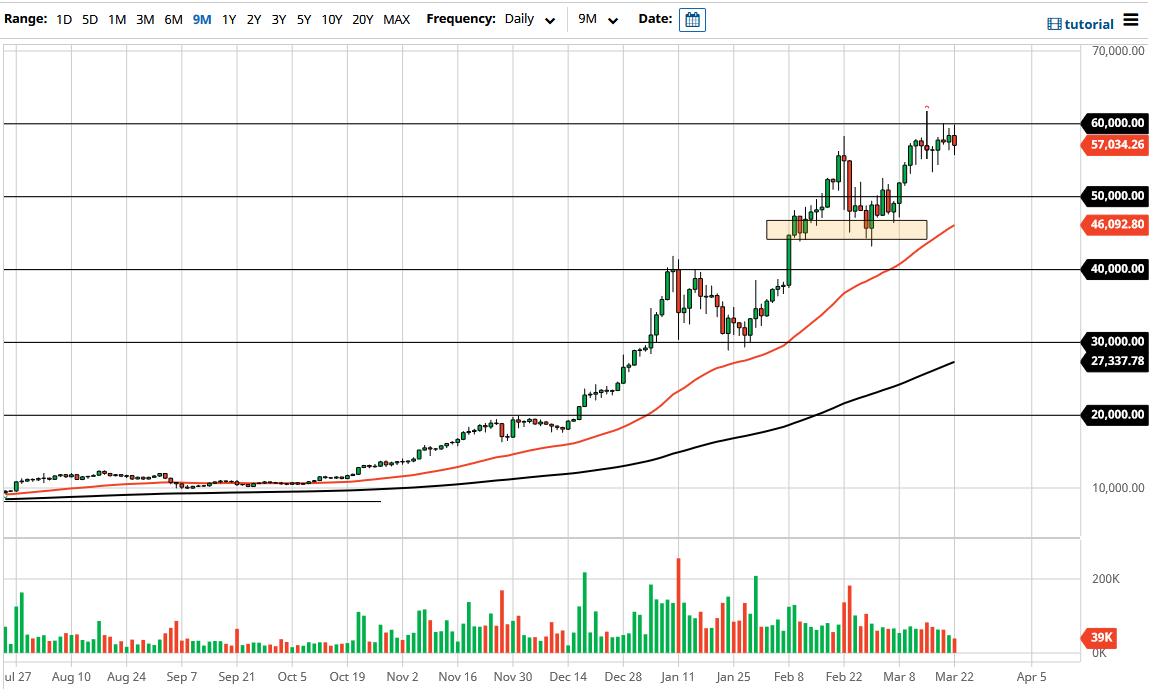

The Bitcoin market has gone back and forth during the course of the trading session on Monday, to lose roughly 2% by the end of the session. All things been equal, this is a market that I think continues to see a lot of upward pressure but obviously the $60,000 level has been significant as far as a barrier is concerned. If we can break above that level, then it is likely that it will kick off the next “leg higher” in Bitcoin.

To the downside, I think there are plenty of support levels that should come into play, especially near the $50,000 level. I do not know if we can break down below that level, but if we were to do so, then I think the market would see a significant amount of support at the $45,000 level as well, based mainly upon the 50 day EMA and the fact that we have already seen buyers in that general vicinity to begin with. After all, we are in a major uptrend and I do not think this is going to change anytime soon.

If we broke down below that $45,000 level, then I would be a little bit more concerned about the market, because we had seen such a major parabolic move to the upside. However, I think at the moment, this is a market that cannot be shorted, so overall I think that the market is one that you simply look for dips to start buying again, as they offer value in what is an extraordinarily strong market. As far as a target is concerned, I have no idea where that enzyme, but clearly if you are a longer-term trader there is no reason to short anytime soon.

Looking at the shape of the candlestick, it tells us that there is a lot of confusion at this point, and of course exhaustion. All things being equal, this is a market that will eventually trying to break out, but pullbacks will be thought of as opportunities and I think that is just how you have to look at this market. If we did break down below the $45,000 level, then I think we would have to revisit the $30,000 level which is even more important from a longer-term standpoint. I have no interest in shorting this market even though it has gotten ahead of itself.