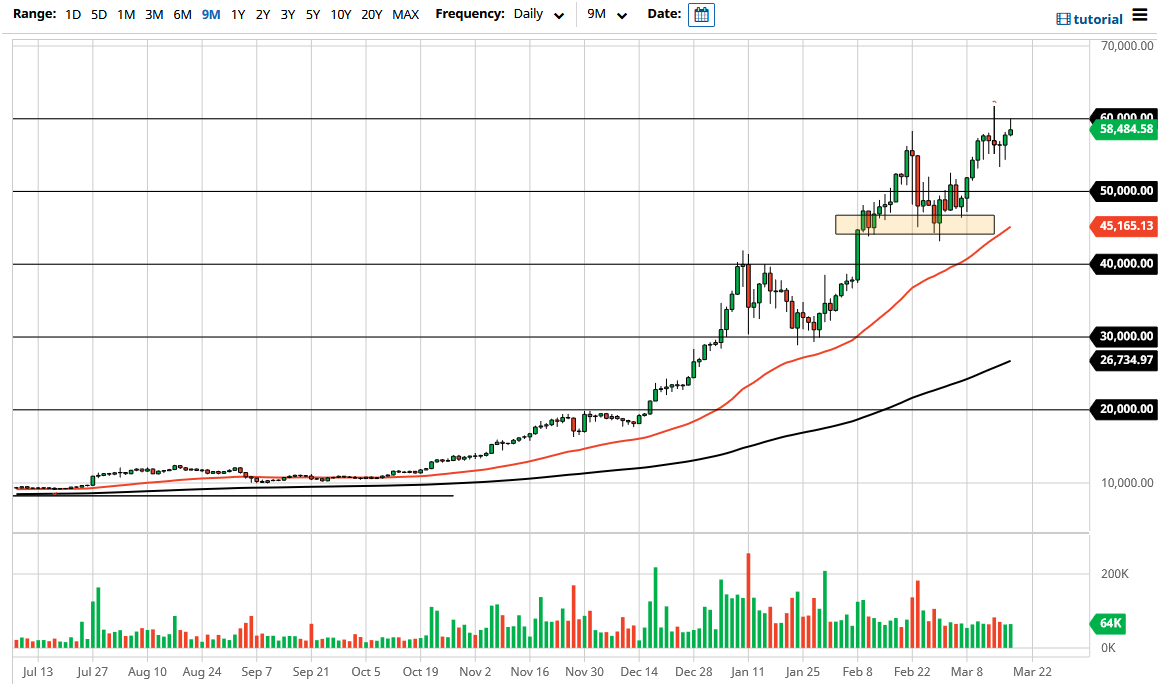

Bitcoin markets rose again during the trading session on Thursday as we try to take out the $60,000 level. This is an area that has a lot of psychology attached to it, so it should not be surprising at all to see that there might be a little bit of a fight going on here. I do believe that eventually the buyers will win the argument, although it may take several short-term attempts. It also would not surprise me at all to see this really take off during the weekend when there will be less liquidity.

I believe that we will not only break the recent high, but then go looking towards the $65,000 level. After all, the Bitcoin market has had plenty of opportunities to sell off, but nobody seems to do so. With more institutional money coming into the fray, it does make sense that we would ultimately see market participants look for every dip as a potential bit of value. We are seeing this all across the crypto currency space currently, with other coins such as Polkadot, Ethereum and Cardano all rallying recently.

Whether or not this continues might be a completely different question altogether, but I think the odds are that it will. Overall, this is a market that has multiple support levels underneath, namely the $55,000 level, the $50,000 level and most certainly the $45,000 level, where we have not only seen a lot of support come in on multiple occasions, but we also have the 50-day EMA sitting at. Because of this, it will be interesting to see how any pullback reacts, but so far it has to be said that the buyers have been very aggressive protecting Bitcoin. Based upon recent market structure, it is not a real stretch to think that we would gain another $5000 if we can break above the $60,000 level. However, you can even break it out to a possible $10,000 gain. With that being the case, I like buying dips, and personally while I am not a Bitcoin holder, I have been buying some of the other currencies mentioned in this article. If you are already long in this market, there is nothing on this chart that would suggest you should get out.