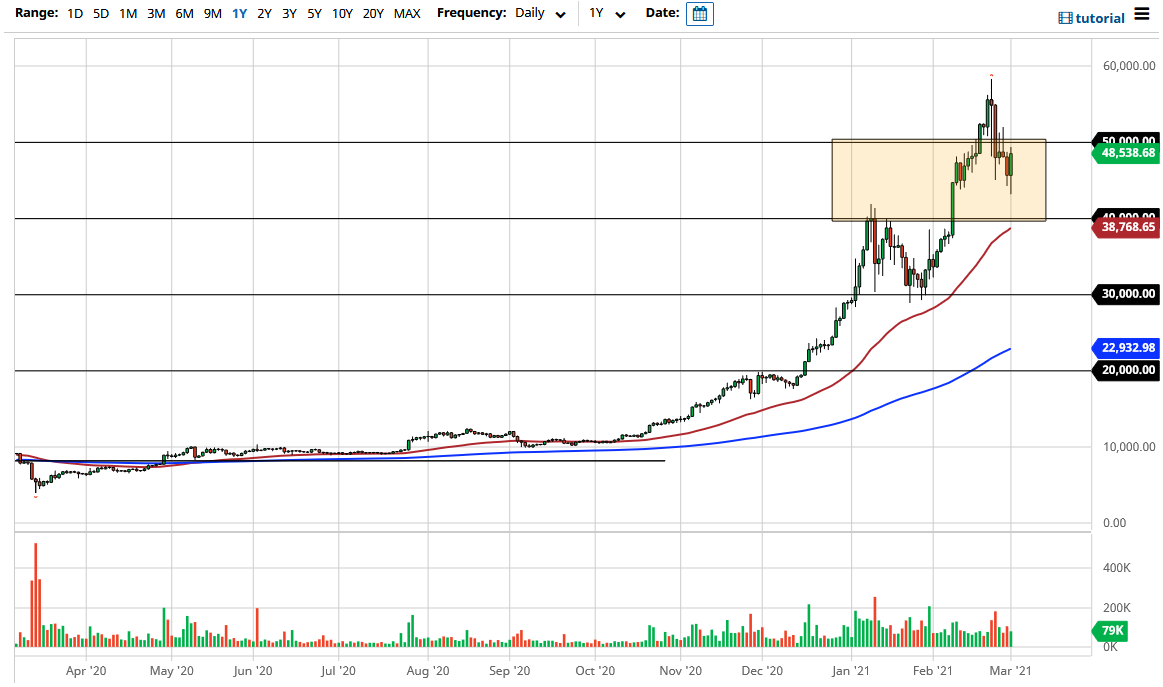

The Bitcoin market was very volatile during the Monday trading session, initially breaking down below the $45,000 level only to see buyers turn around and push this market higher. The market dropped as low as $43,200, only to turn around and show signs of life again. Looking at this chart, you can see that the rally reached towards the $50,000 level before pulling back ever so slightly. The $50,000 level is very psychologically important, so it will attract quite a bit of attention.

You could talk about the $50,000 level being broken to the upside as a bullish sign, and I think you need to see a daily close above there before getting involved again. The structure of the market is obviously very bullish, and even though Bitcoin is extraordinarily volatile, the direction you should be looking at is higher, not lower. Furthermore, the $40,000 level underneath is even more supportive, not only due to the fact that it was the most recent break out, but it is also where the 50-day EMA is now starting to approach. In other words, “market memory” and the EMA above should attract enough technical traders to get involved and start pushing the market higher, assuming that we can even get down there.

If we were to break out above the $50,000 level on a daily close, then it is very likely that we could go back towards the highs again. Risk appetite in general seems to have returned to the market, so that should help Bitcoin in general. With that in mind, I like the idea of buying dips still, but I would not jump into the market with both feet right away, because the volatility is going to continue to be an issue. If the market was to break down below the $40,000 level on a daily close, then it is obvious that we would have further downside to go, and perhaps reach towards the $30,000 level. But Bitcoin certainly looks as if it is going to continue to try to grind higher, so unless something structurally changes, this is a market that I think continues to drive itself higher based upon expectations of institutional money getting involved.