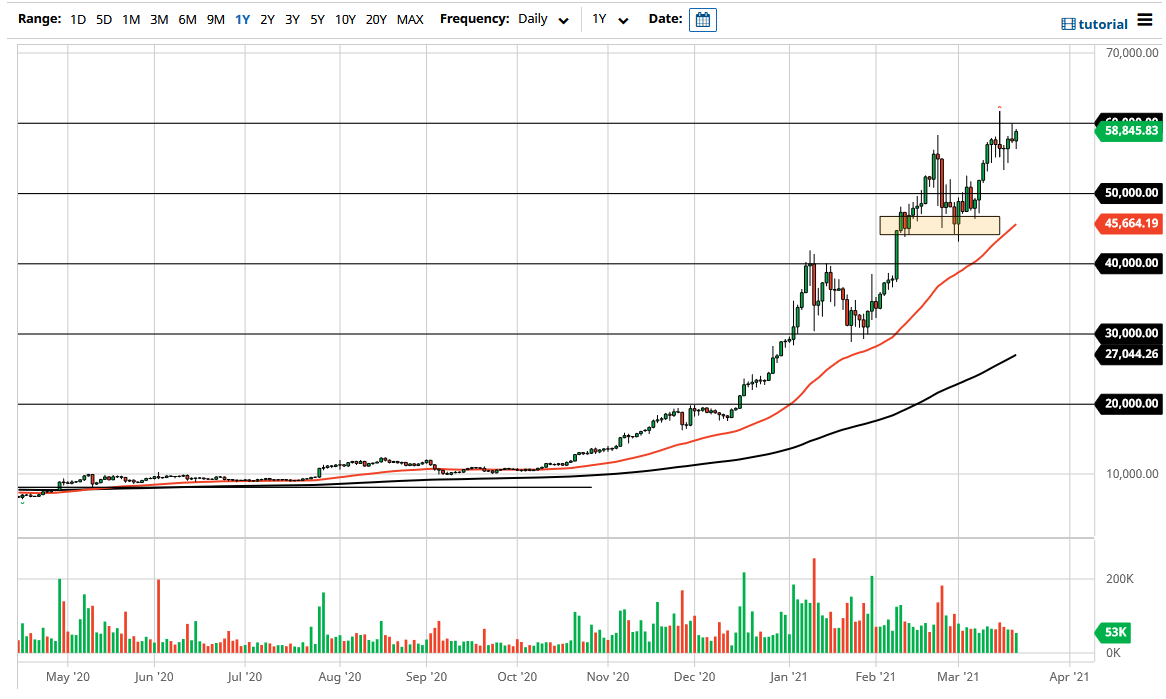

Bitcoin markets initially pulled back during the trading session on Friday but then shot higher as markets continue to look at cryptocurrencies as a way to get away from fiat currencies. This is a market that I think will continue to see upward pressure, although the $60,000 level has been extraordinarily difficult to break above. Nonetheless, when you look at the structure of the market, it looks as if we are starting to turn higher again, so I would not be surprised at all to see the markets break above the $60,000 level this week.

Bitcoin is approaching the top of the shooting star from the Thursday session, so breaking above there would not only break the $60,000 level, but it would also be an area where we would be breaking through significant resistance based upon candlesticks as well. Once that happens, I would anticipate that Bitcoin would go looking towards the $62,000 level next.

Between now and then, any time this market pulls back I suspect that there will be buyers, although I wish I would have seen more of a pullback than just simply going to the $55,000 level. That is one of the biggest problems with trying to trade Bitcoin: the pullbacks quite often are not deep enough to be comfortable with. This may possibly be due to the fact that plenty of institutional investors are getting involved in it as well, as it brings in big amounts of money.

Underneath, the $45,000 level has been supported and we have the 50-day EMA sitting at that area as well. For me, that is essentially going to be the “floor in the market” at the moment. As long as we do not get there quickly, I think that any pullback towards that area would be a nice buying opportunity. Longer term, I am not sure where Bitcoin will end up, but there is nothing on this chart that suggests it cannot go much, much higher. The one thing that sometimes will work against Bitcoin is the US dollar strengthening, but really at the end of the day that has only been a secondary issue.