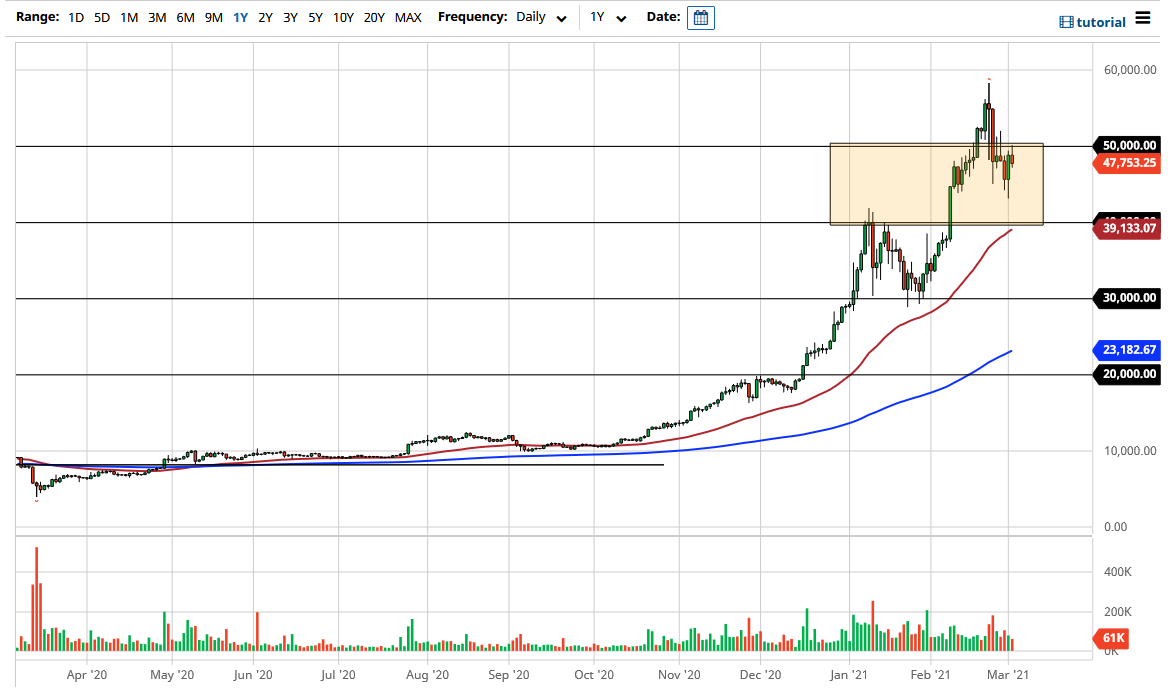

The Bitcoin market rallied significantly during the trading session on Tuesday only to struggle at the $50,000 level again. By pulling back from there, we are seeing a market that continues to view the $50,000 level as a massive psychological barrier. I do not necessarily think that we are suddenly going to reverse the trend, but we could see some type of pullback to find a certain amount of support. I think that the $45,000 level should continue to see a certain amount of support and attention. We could break down below there as well, which I think would actually be rather healthy.

If we do break down below the $45,000 level, then it is likely that the market could go down to the $40,000 level. That would be an area that a lot of people would be interested in, because it is an area that has yet to be tested after being broken above. The 50-day EMA is sitting just below there, so I think it all lines up quite nicely for a potential “buy on the dips” type of scenario.

On the other hand, if we were to break above the $50,000 level, it is likely that we could go much higher, perhaps towards the $55,000 level and then eventually the $60,000 level, as it is the next big figure that people will be attracted to. In general, I do not have any interest in shorting this market, although it is certainly one that desperately needs some type of bigger pullback so that value hunters can get involved in. I think at this point any type of massive sell-off will be treated as a value proposition, unlike a few years ago, because people have seen just how resilient this market can be. However, institutional investors are starting to flood into this market, so dips will be much shorter than they once were. Because of this, I think that this market will continue to be very choppy but positive in general. Looking at this chart, I do believe that the $60,000 is a very reasonable target, but I do not necessarily think that it is going to be easy to get to in the short term.