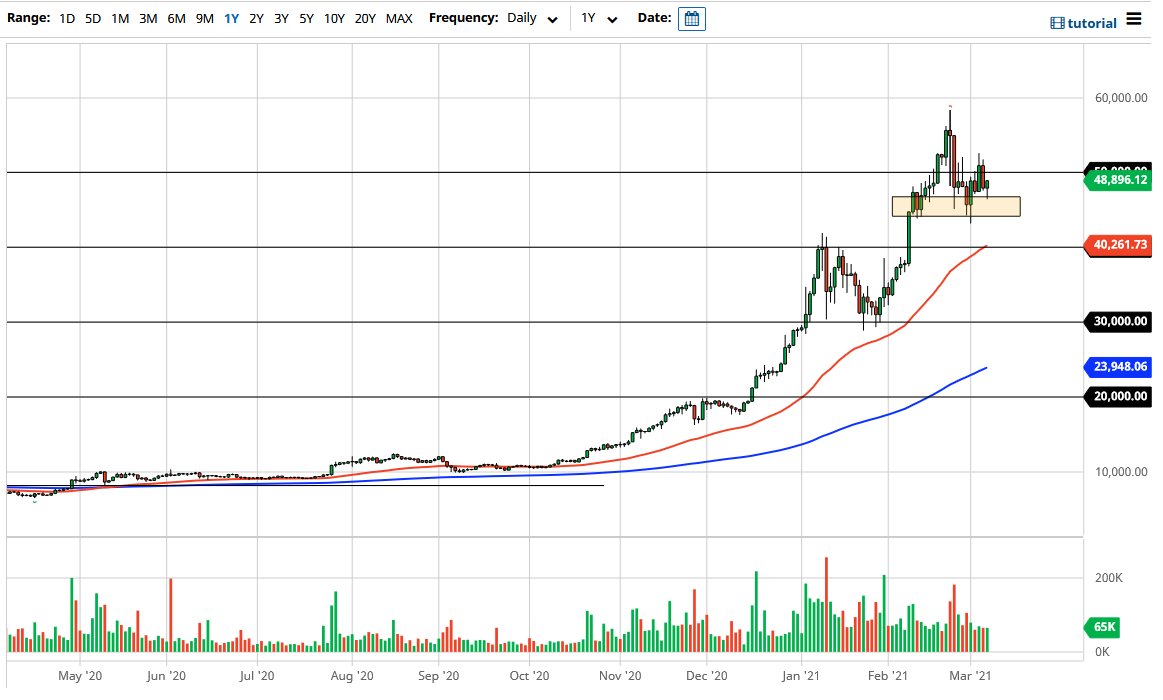

Bitcoin markets initially pulled back during the trading session on Friday to test the support that we had established a couple of days ago. That being the case, we then turned around to form a hammer. This is a constructive-looking candlestick, but at this point the market is simply consolidating, perhaps killing time and getting used to the idea of being near the $50,000 level. The market continues to be very noisy, but we are obviously very bullish in general.

At this juncture, all we are doing is trying to work off the froth in the market. The 50-day EMA is currently sitting at the $40,000 level, and I think that is essentially the “floor in the market” at the moment, as it was previous resistance. We exploded to the upside from there, and then raced to the all-time highs. I think at this point we will probably see a lot of back and forth and try to build up enough momentum to finally get back towards those highs. I still believe that Bitcoin is going to be aiming for the $60,000 level based upon the previous consolidation, and I think a lot of traders are simply trying to get the market to go to that level.

There has been a lot of institutional inflow as of late, but there is even more to come due to the fact that a lot of them are looking for some type of value to get involved in the market, because we are overbought so often. The market had gotten to this level so quickly that it makes sense that we have to “chop wood” in the meantime, because in the month of December alone we gained 40%. The market continues to see a lot of buyers every time it drops. That is really all you need to know, and it does look like Bitcoin is going to continue to show signs of strength. The signs of inflation are out there, and the massive amount of monetary policy that the Federal Reserve continues to do, right along with Congress and its stimulus package, should continue to weigh upon the idea of fiat currencies struggling.