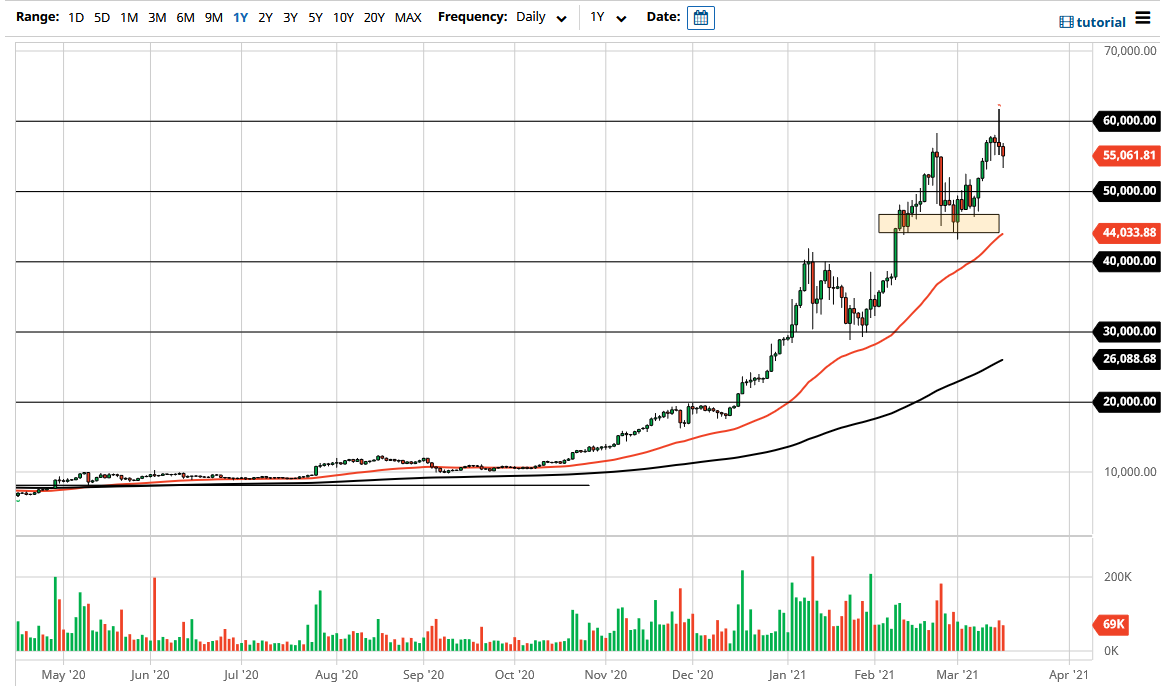

The Bitcoin market fell during the trading session on Tuesday to break down below the lows of the last couple of days. Furthermore, we broke down below the $55,000 level, but saw a bit of a recovery later in the day, so that does bode well. If you watched yesterday, you know that I suggested that we would get a pullback, and that could continue to be the case. Nonetheless, I think what the session on Tuesday has shown us is that there are still plenty of buyers underneath, and therefore the thesis still holds true that there will be buyers underneath willing to pick up “value” when it appears.

The $50,000 level underneath would be the first major support level, followed by the $45,000 level that I think is massively supportive, not only based upon recent action but also the fact that the 50-day EMA is sitting in that same general vicinity. The market has shown itself to be in a strong uptrend, and that will not change anytime soon. I think that the market has massive support all the way down to the $40,000 level. If we were to break down below there, then things could get rather ugly, but I do not see that happening in the short term.

To the upside, if the market does break above the $60,000 level it will allow Bitcoin to go much higher. It is clear that a lot of the noise has been due not only to people chasing momentum, but also the fact that institutional money is starting to flow into the cryptocurrency area as well. Bitcoin is the obvious first place that a lot of them go to, so I think at this point it is likely we will see more of a “buy on the dips” type of marketplace and mentality going forward. Regardless, there is no way you can short this market, at least not anytime soon, so at this point it comes down to whether or not we can see some type of bullish bounce from which to pick up Bitcoin at lower levels. Otherwise, if we were to break above the shooting star from the Monday session, that would be an extraordinarily bullish sign.