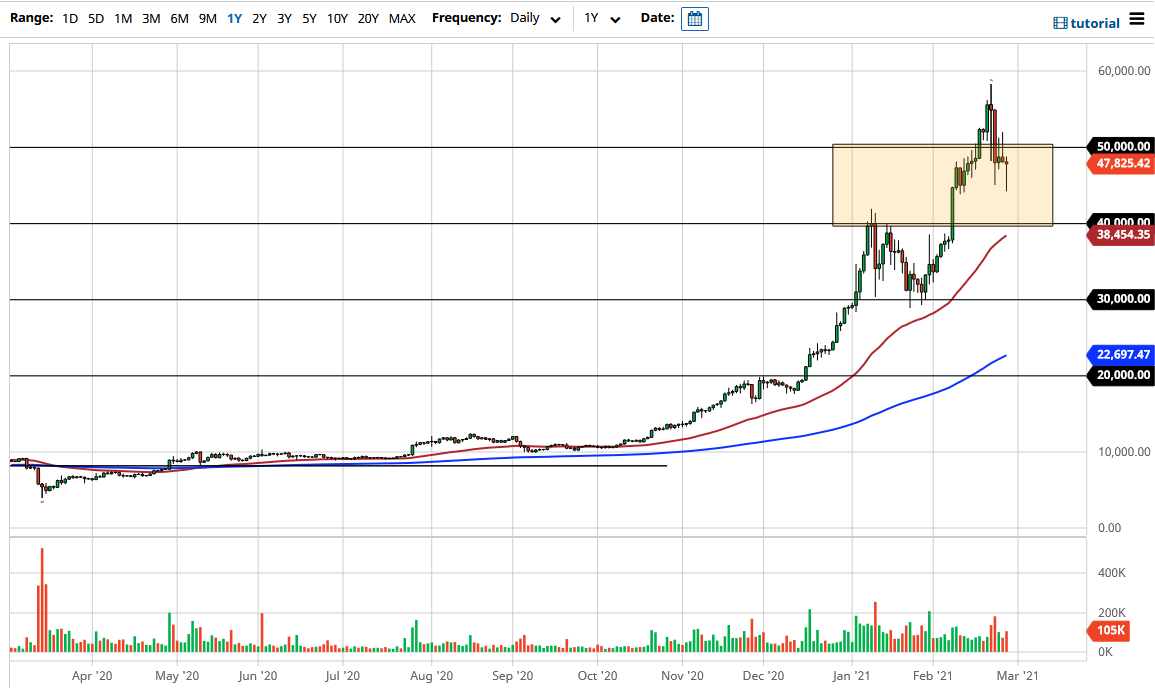

Bitcoin markets fell rather significantly again during the trading session on Friday, which is not a huge surprise considering that we had formed a couple of shooting stars around the $50,000 level. However, we did find buyers right around the $45,000 level, which was where we have seen support in the past. The next question is whether or not we can maintain that $45,000 level as support. Even if we do not, I think that the $40,000 level underneath is going to be even more supportive, so at this juncture I would not be overly worried even if we do break down below the bottom of the hammer from the Friday session, which would typically be a very toxic sign.

To the upside, obviously the $50,000 level continues to be very resistive, but we have broken above there before so it would not necessarily be that surprising if we do it again. I think at this point the biggest problem Bitcoin has is that it simply rallied too quickly. Looking at this chart, it is obvious that reality had to sit back in. After all, you can only escape gravity for so long. Nonetheless, even if we do get that breakdown towards $40,000 over the next several days, the 50-day EMA and the previous breakout point should both come into play and provide enough support to lift the market.

Most cryptocurrency traders do not follow the bond market, but we have seen yields rising in the United States. That drives up the value of the US dollar, and now that the institutional traders are starting to play more in this sector, you will start to see the bond yields come back into play and affect this market as well. This is a whole new world for cryptocurrency if it is going to actually be traded by hedge funds, so the rules will change sooner rather than later. Ironically, this is probably going to become a market that people will not recognize, and some of the old guard will probably lament. Nonetheless, it is a bullish market and, at the end of the day, that is the most important thing to pay attention to as shorting it is almost impossible. It looks like we will remain a “buy on the dips” scenario.