Last Monday’s Bitcoin signals produced an excellent, profitable long trade from the clear bullish bounce off the support level at $49,340 at the start of that day’s London session.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades my only be entered prior to 5pm Tokyo time Thursday.

Long Trade Ideas

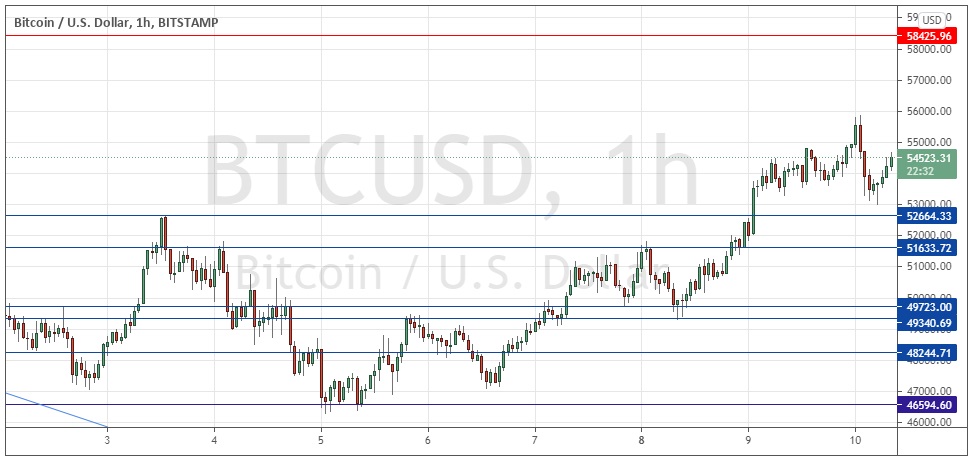

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $52,664, $51,634, $49,723, or $49,340.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Idea

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $58,426.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Monday that the technical picture was still bullish but weakly so, therefore I thought that the best scenario to wait for here was going to be a bullish breakout above $51,837. I thought the best opportunity which was most likely to set up would be some long trade.

This was a good, accurate, and profitable call, as the price is now approximately 5% higher following that second consecutive hourly close which we got above $51,837 later during last Monday’s New York session.

There are a few bullish signs – the invalidation of the former resistance level near $55K means there are no obstacles left to a further price except the all-time high at $58,426. The price made a clearly bullish turn a few hours ago and has moved up cleanly from there.

Overall, it looks likely that Bitcoin will continue to advance today and may even rise strongly enough to hit a new all-time high, which will likely trigger more speculative frenzy and perhaps a move to considerably higher prices above $60K.

There is a chance the price will be held down by minor resistance from the previous swing high inflection confluent with the round number at $56k.

Some bullish Bitcoin analysts argue that the full impact of the 2020 Bitcoin halving has yet to be felt, pointing to much stronger price rises seen following previous halving events in 2012 and 2016 than has been seen since the most recent halving in 2020. Regarding the USD, there will be a release of CPI (inflation) data at 1:30pm London time.

Regarding the USD, there will be a release of CPI (inflation) data at 1:30pm London time.