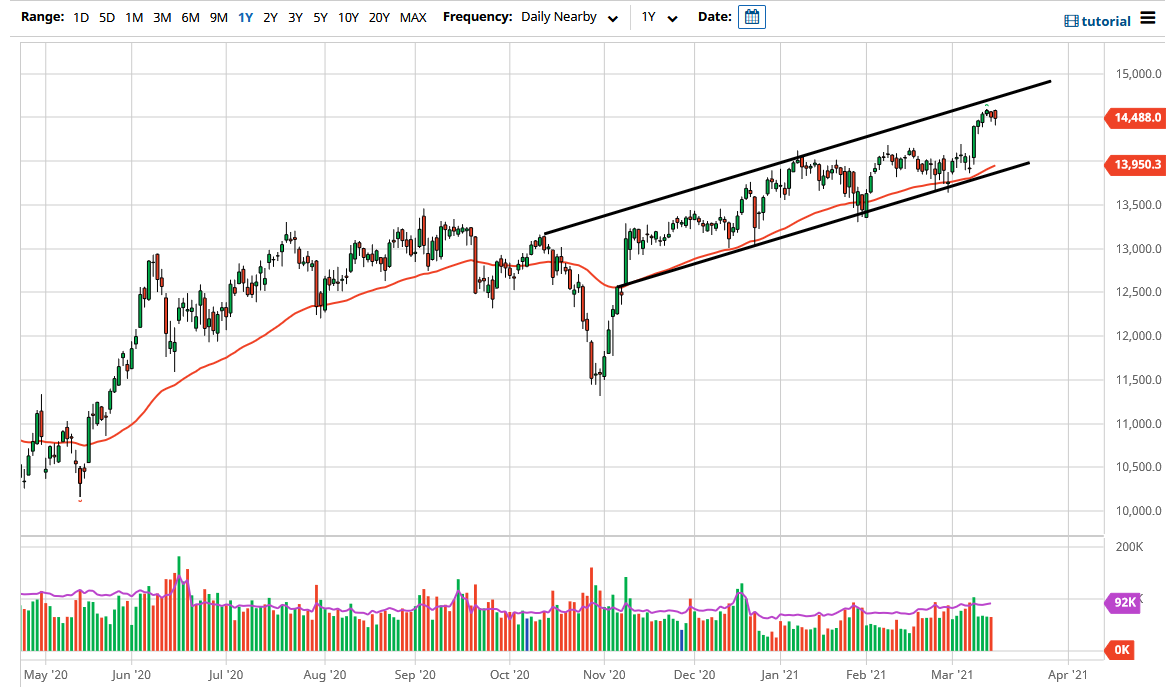

The German index fell a bit during the trading session on Monday to kick off the week, as we continue to hang about the 14,500 level. Having said that, the market is near the top of an overall channel, so I would not be surprised at all to see the market pull back a bit to find enough momentum to continue the run higher. However, if we do turn around a breakout to the upside, I think the next target will be 15,000, which has been my longer-term target for some time. What is worth noting is that recently we had a very impulsive candlestick to kick off the week last week, and we have seen a nice ability to simply sit still since then. That implies that the market is getting comfortable being at these elevated levels.

If we do break down below the bottom of the candlestick for the trading session on Monday, then I think we probably drift towards the 14,250 level. Underneath there, we have an uptrend line that would also come into play and attract a lot of attention. In fact, that uptrend line basically determines the overall trend right now, so as long as we can stay above there this is a “buy only” type of market. This makes sense, because the DAX is an industrial Index more than anything else, and a lot of traders around the world are starting to get away from growth companies, and start adding value companies, something that a lot of the DAX is full of at the moment.

The fact that we did bounce a bit from the bottom of the session on Monday suggests that there are plenty of buyers underneath that are looking to support this market. Because of this, if we do pull back, I am not looking to short this market, nor would I be worried about the overall trend. I think is simply an opportunity to buy the DAX “on the cheap.” In fact, is not to we break down below the 13,500 level that I would be concerned about the trend in general, and therefore I will be looking for entries, either on a breakout above the top of the channel, or on a pullback that shows a bit of a bounce on a lower timeframe.