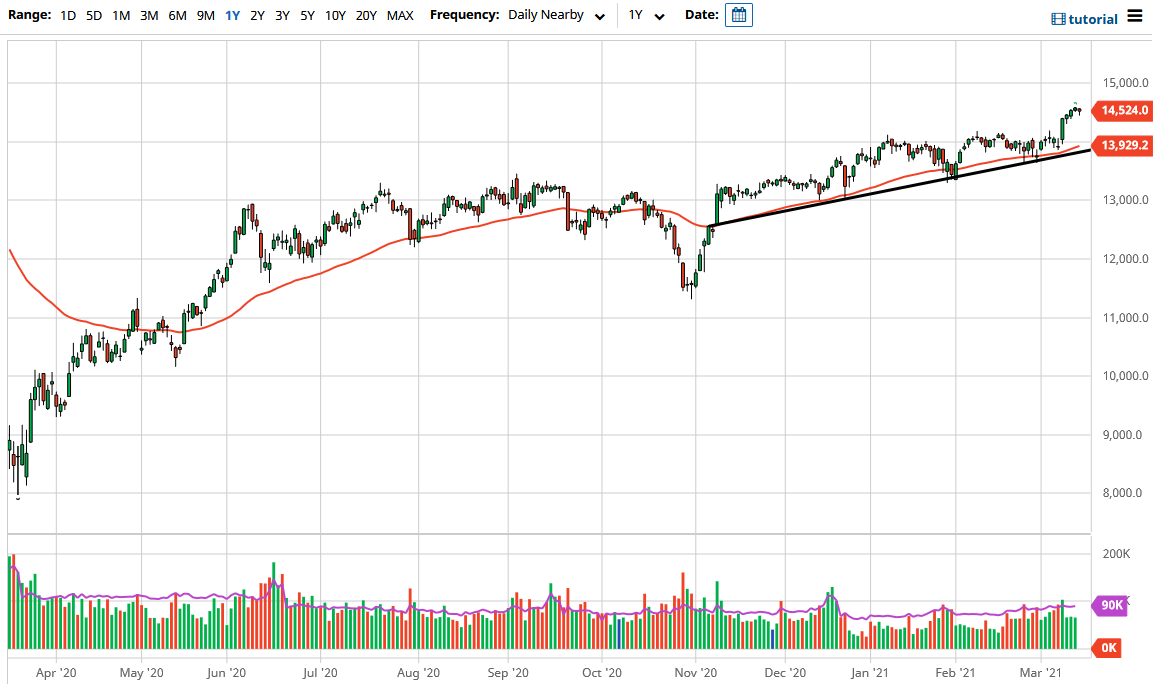

The German index fell slightly during the trading session on Friday but then turned around to show signs of strength yet again. This is a market that has been stubbornly bullish, by which I mean it has refused to back down. It is not necessarily that we have been parabolic as of late, and you could make an argument for a miniature “rounded top”, but that simply should just be a pullback to pick up more value. The 50 day EMA underneath is hugging the uptrend line, so I do not have any interest in shorting this market until we break down below that level at the very least. All things being equal, I think that the DAX is trying to get to the 15,000 level.

We have been in an uptrend for some time, and when you look at the overall attitude of the market since November, it has been a nice channel that we just simply continue to grind back and forth and with relative ease. I have no interest in trying to get too cute with this market, I think that pullbacks are opportunities to get involved, and I think you simply plug away like we have been for some time until proven incorrectly.

The real question is what happens untill we get the 15,000? I think it is going to be difficult to break above as it will cause a certain amount of psychological resistance, and of course it is a large number that will create a lot of headlines. It is not that we cannot get above there, it is just that it may take a couple of attempts to finally get above there. With that being said, I like the idea of looking for value and taken advantage of it. After all, the DAX is full of exporting companies that lead the world in industrial components and production, so it does make sense that the DAX should continue to perform well in a scenario that is basing trading on the idea of a reopening world. I have no interest in shorting, and I do think that we are going to be drawn towards the 15,000 level over the next couple of weeks. That being said, we are currently a little sluggish, but I do not think that changes anything longer term.