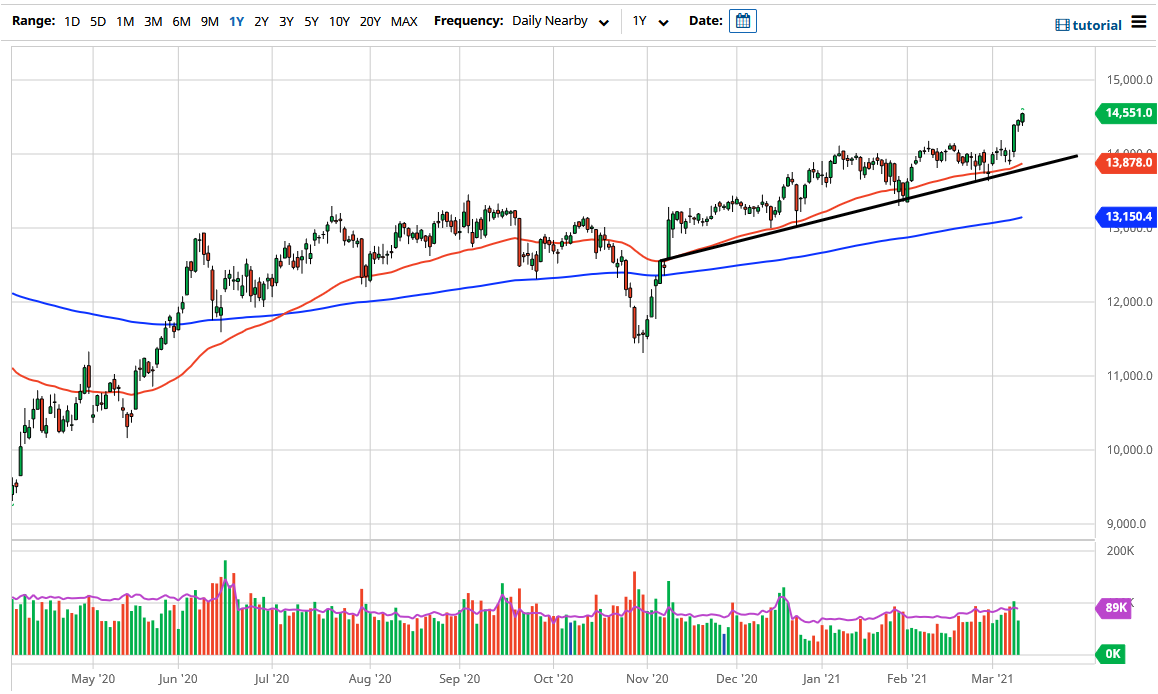

The German index broke above the crucial 14,500 level during the trading session on Thursday, as we continue to see a lot of momentum pile into this market. The Monday candlestick was a massive amount of momentum in a market that had been simply going sideways for a while. Now that we are above the 14,500 level, I do think that we are eventually going to go looking towards my target of 15,000 above, but it may take some time to get there. After all, you cannot get there overnight but I do believe that what we are looking at here is an opportunity to continue grinding higher.

To the downside, I believe that the 14,000 level is massive support, not only due to the fact that it is a large, round, psychologically significant figure, but it is also where we had seen a lot of accumulation form, as well as the 50 day EMA turning up just below it. Below there, we also have the uptrend line, so I think at this point in time there are plenty of reasons to think that this market goes much higher.

The German index will continue to be favored by people looking to put money into the European Union, due to the fact that we have the “reopening trade” getting involved and I think that will continue to see money flow into a large industrials and that favors the DAX 30 itself. Pullbacks are to be bought into, and I have no interest whatsoever in trying to short this market. If we do break down below the uptrend line, then I think the market may “reset” closer to the 200 day EMA.

I do believe that the impulsive candlestick from the Monday session was the beginning of the “next leg higher”, and now that we have seen bond rates start to drop a little bit around the world, that also helps indices worldwide, not just the DAX. All things being equal, I think that the market will continue to attract a lot of inflows, especially as the German index is considered to be the “blue-chip” index that European traders pay attention to, and of course money flows from all over the world into it when people are starting to show risk appetite coming back. I do believe that the DAX will lead the other indices in the region such as the CAC, MIB, and IBEX.