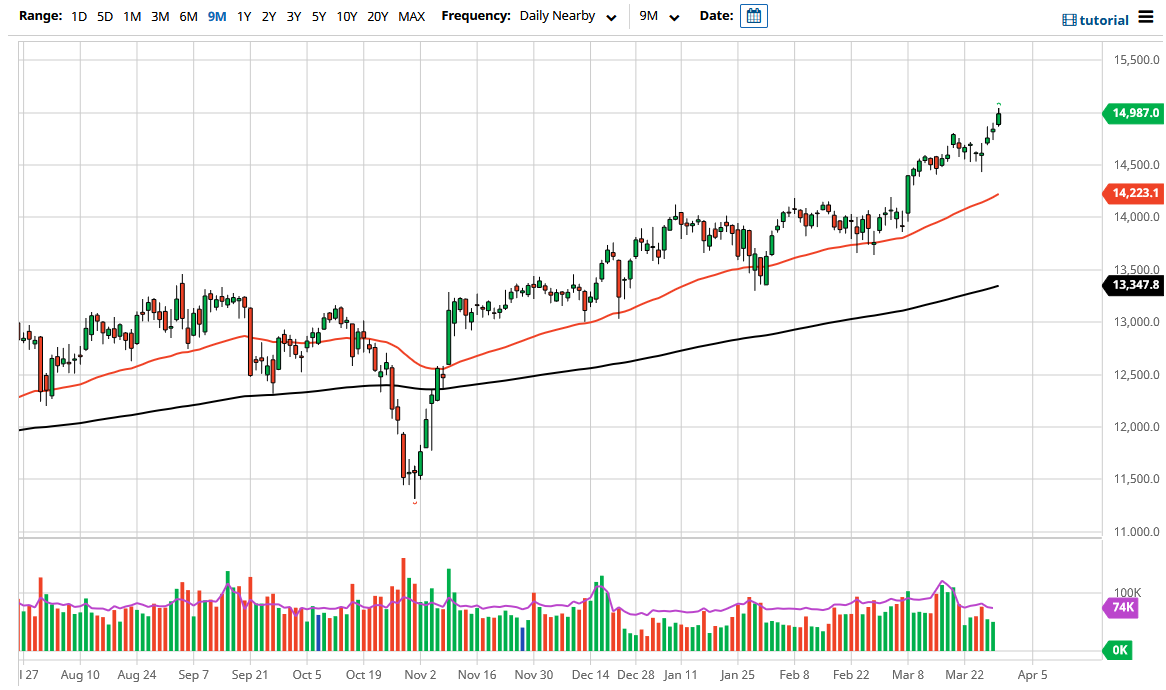

The DAX rallied significantly during the trading session on Tuesday to finally reach towards the 15,000 level. That is an area that I have been calling for over the last several weeks, and now we have reached it. Whether or not we can break above the 15,000 level is an open-ended question, but I do think it happens given enough time. Ultimately, I do think that we probably need to pull back a bit in order to build up enough momentum to continue going higher.

To the downside, the 14,500 level should be a bit of a floor, as we have seen a lot of noise in this general vicinity. The 50 day EMA is starting to reach towards that area, as the 14,500 level seems to be the destination. That should be an area where we would see a lot of confluence that should continue to push the market higher. If we break down below the 50 day EMA, it could open up a move down to the 14,000 level. That is where we had seen a massive breakout previously, so at this point in time I would anticipate that we would see a significant amount of support due to “market memory.”

The DAX has been rallying due to the idea of the overall global economy reopening, and therefore it is likely that we will see demand for industrial components, like the ones that are so heavily prevalent in the DAX 100 Germany is a major exporting country, so it is reflected in this price.

The European Central Bank is also in the middle of stepping up its purchases, so one would have to think that lower interest rates in the European Union will continue to help the DAX as well. Remember, stock markets have very little to do with the underlying economy, so this is why stock indices around the world continue to ignore things along the lines of lockdowns and the European Union. At this point, it is about liquidity more than anything else and therefore we should continue to see buyers on these dips. On the other hand, if we break above the highs of the day, then it just opens up the possibility of a move to the 15,250 level. Regardless, I have no interest in shorting the DAX, because at this point in time it looks like the ECB is going to step up its efforts to support markets just as the Federal Reserve has been doing.