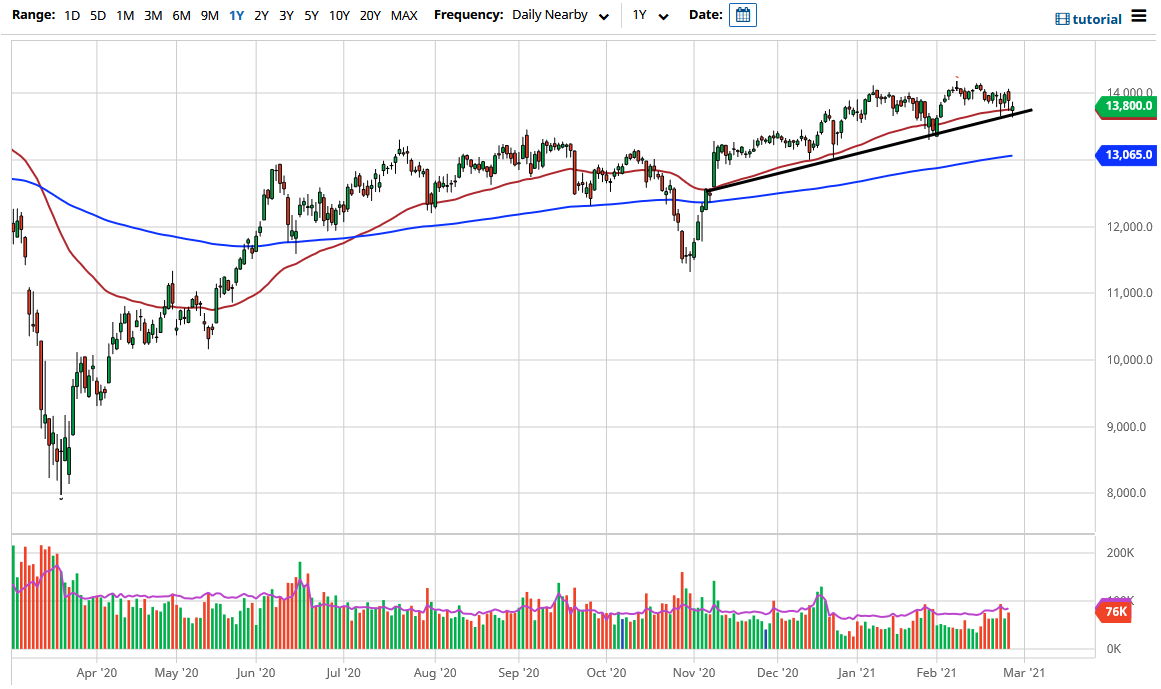

The DAX index gapped lower to kick off the trading session on Friday, right before we crashed into the uptrend line that I have drawn on the chart. Looking at this chart, the 50-day EMA is sitting right at the uptrend line as well, so it does make sense that we would see plenty of support. At this point, the market is likely to see quite a bit of support in this area, and when you look at the candlestick, it is a neutral candlestick, suggesting that we are at least trying to fight off the selling pressure that came in.

To the upside, the 14,000 level continues to be a major issue, and I do think that eventually we will try to break above there. Having said that, bonds around the world continue to see higher yields, and that works against stocks after a while. This is a market that I think is trying to build up the necessary pressure to make the bigger move, and it is very likely that we will see an attempt to get to the 15,000 level.

The DAX is highly sensitive to the idea of global growth, as so many of the major companies that make up the DAX are major exporters of industrial machinery and the like. After all, Germany is the “factory of Europe”, so if we continue to see a reflation trade or some type of recovery, it stands that German companies should be some of the main beneficiaries in that scenario.

However, if we start to see more negativity out there, we could see this market break down below the uptrend line, opening up a move down to the 13,000 level. The 13,000 level is basically where the 200-day EMA sits, so it makes sense from a technical analysis standpoint that people would be keeping an eye on that level. Looking at this chart, I do think that we are going to continue to grind sideways in general with more of an upward proclivity. I have no interest in shorting the DAX, at least not in the easy money and environment in which so many people are pricing.