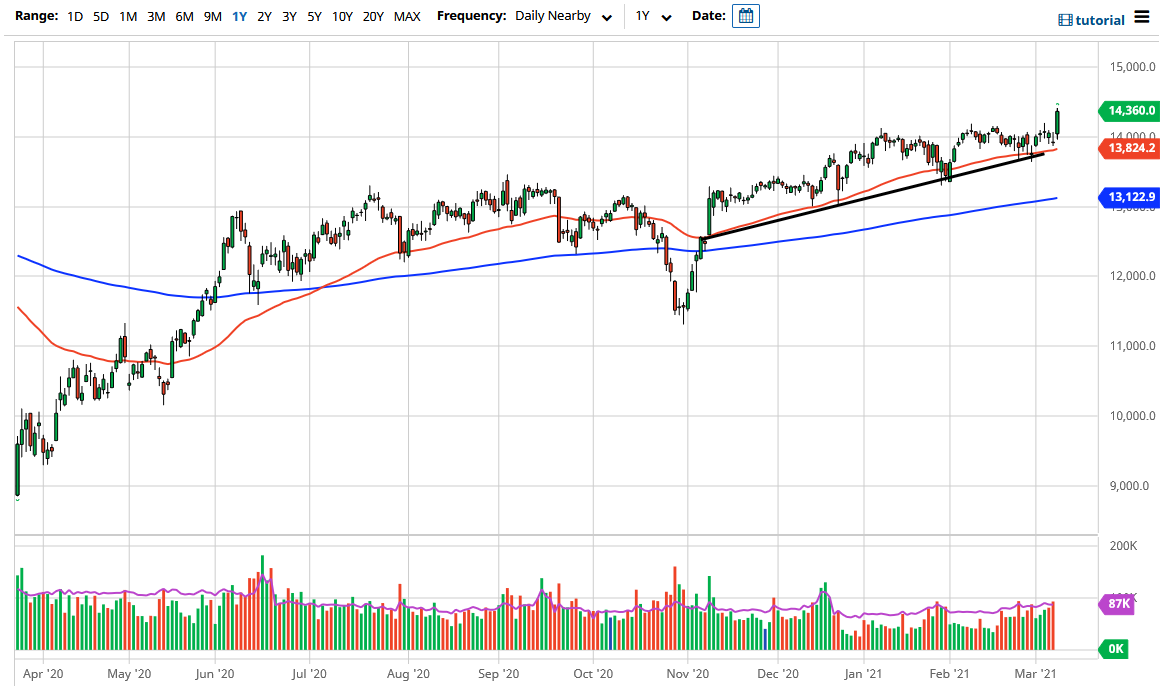

The DAX broke higher during the course of the trading session on Monday to break above the 14,250 level. By doing so, the DAX has finally shown the ability to continue going higher, as I have been counting on for some time. Now that we have broken above here, we have to look at the 14,000 level as an area of significance, as well as the 50-day EMA which sits just below. After that, we also have a massive uptrend line that comes into play and should offer plenty of support also.

I believe that the DAX will continue to rally again based upon the idea of the global economy recovering, as the German index is full of major exporting companies. As the global economy needs more heavy industry to support it, this will tie in quite nicely with the DAX itself. At this point, we have been in an uptrend for quite a while, and this explosive candle is a good sign that we are going to continue to go much higher. I do believe the dips along the way will continue to be buying opportunities. The uptrend line underneath would define the overall trend, and I think that it is only a matter of time before buyers will continue to take dips as an opportunity to get long.

The 14,500 level would be the next resistance barrier, and if we can break above there, then it is likely that the market could go looking towards the 15,000 level from the longer-term perspective. The 15,000 level is an area that would attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, and an area where you would probably have a lot of people taking profit based upon that. I do not have a scenario in which I would be a seller of this market anytime soon, unless there was some type of major shift in the overall attitude of the global economy, not just the German index itself. Stock markets in general continue to rally over the longer term, so I think that it is only a matter of time before value hunters come in every time we dip.