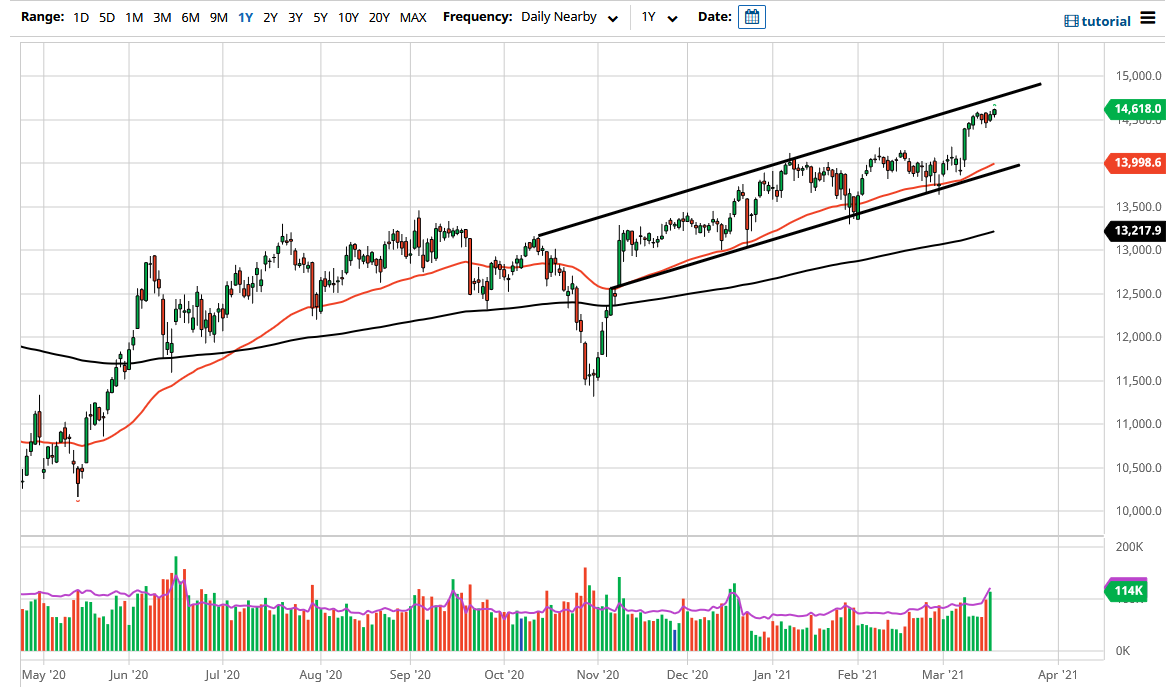

The DAX Index rallied during the trading session on Wednesday as we continue to see the same channel keep the market somewhat constrained. Because of this, I believe it is only a matter of time before we would see some type of resistance above that could keep this market down a bit. That that does not necessarily mean that we are looking to sell off, rather that we are just staying in the same upward range.

The 14,500 level should offer a little bit of support, but if we do break down below there then I think the next major area that we should be paying attention to is the 14,250 level, which is a region that had previously caused quite a bit of resistance. After that, then we are looking at the 14,000 level, which has the 50-day EMA sitting right there and tilting higher. With that in mind, I do believe that we are looking at a scenario that should continue to favor an overall “buy on the dips” type of mentality, so I think we wil continue to see a certain amount of bullish pressure every time we dip. There will be a lot of value hunting.

The DAX will be a main beneficiary of the reopening trade and all of the industrial companies that are on this index will be highly sought after as major industrial components will be in high demand around the world, especially around the European Union, as Germany tends to provide a lot of those major industrial components to the rest of the EU. However, one thing that does keep the DAX a little bit sluggish in comparison to some other indices in places like the United States is the fact that we have had some less than thrilling numbers come out of Germany.

However, as the vaccine rollouts sort itself out in the EU, then it is very likely that we will see Germany be one of the major beneficiaries. With this being the case, I do like the idea of the DAX longer term, but I would like to see some type of pullback in order to find value as we may be just a little bit overextended at the moment. Shorting is not a thought at this point.