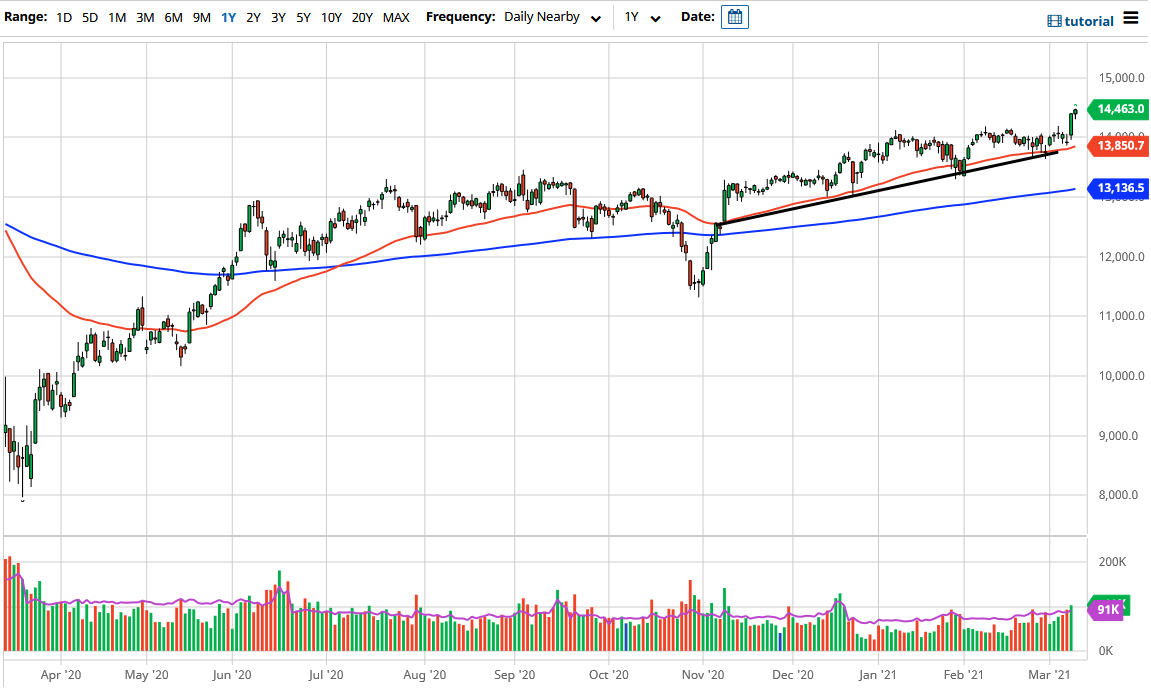

The DAX initially dipped during the trading session on Tuesday but turned around to show signs of strength again as we closed towards the top of the overall range of the session. The market is currently sitting just below the 14,500 level, which is an area that I had talked about as being a potential target. A certain amount of psychological resistance is to be found at the “mid-century mark”, but from a technical and physical standpoint, there is no reason to think that this is a market that is going to simply stop here. I think that longer-term traders will be looking for the 15,000 level, which has much more psychological significance built into it.

When I look at this chart, I think that the 14,000 level will now offer itself as a “floor in the market”, and as you can see, we have launched from there. Furthermore, the market has the 50-day EMA sitting right there, as well as an uptrend line. The bullish candlestick that formed during the trading session on Monday tells me that there is more momentum and excitement about being long of German stocks that there was just a couple of weeks ago. It looks as if we are ready to push higher based upon the momentum, and I do think that it is only a matter of time before we would see a lot of buyers jumping in to chase the strength.

Looking at this chart, I think that the uptrend is firmly ensconced in this market, and people will be looking towards short-term charts in order to pick up value and buy the dip. As long as we continue to see a lot of pressure easing off in the bond market, we should see the market stabilize a bit, as stock markets do not like the behavior that we have seen recently, especially in the US Treasury market. As long as bond yields can stay somewhat stable, I think that we will have traders jumping back into stock indices around the world, not just in Germany. For what it is worth, the German index does represent the “reopening trade” for a lot of economies, as it is so heavily industrialized by the large companies that lead the DAX itself.