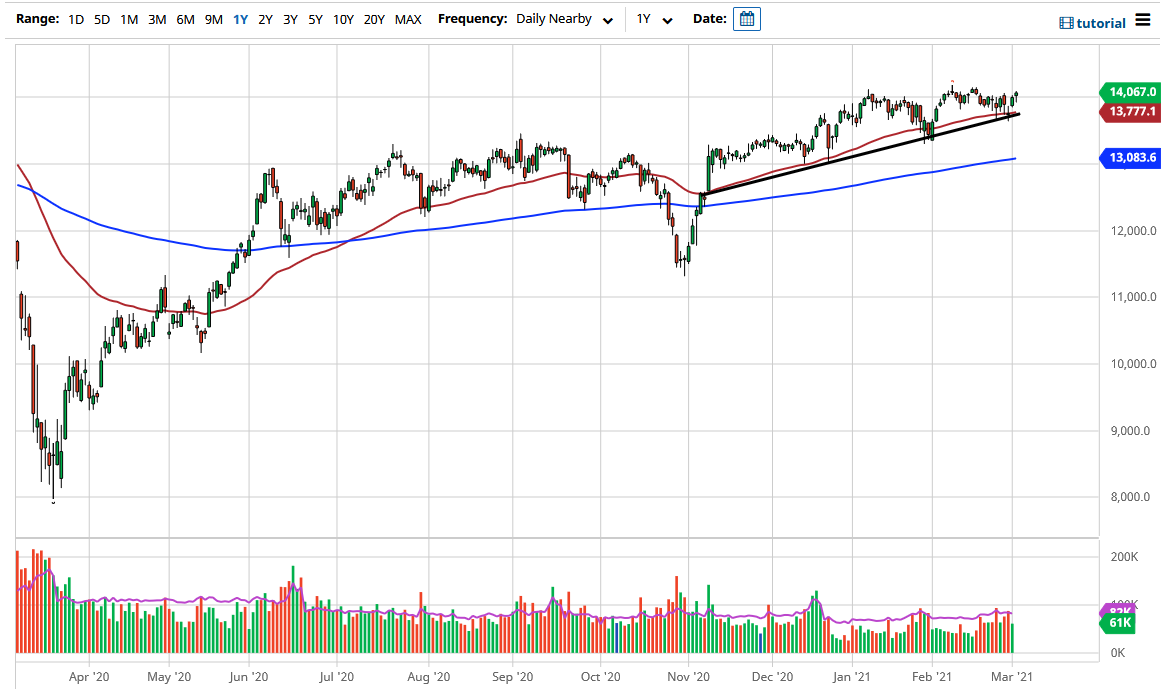

The DAX index initially pulled back a bit during the trading session on Tuesday but found buyers underneath the 14,000 level to continue to push to the upside. Now that we are above the 14,000 level, it is likely that we could go much higher. The 14,250 level is the first resistance barrier that I see, but if we can break above there then it is likely that we will go looking towards the 14,500 level. I still to this day have a target of 15,000 above, and I think that it is only a matter of time before we get up there.

To the downside, there should be plenty of support near the 50-day EMA and the uptrend line that I have marked on the chart. We have already seen this play out during the session on Tuesday, that there are buyers underneath willing to jump in. Furthermore, as long as the euro can stay in the relatively stable range that we have been in recently, it allows for the idea of exports to continue to see growth coming out of Germany. Furthermore, manufacturing in the Eurozone was stronger than anticipated during the trading session, so that also could be a driver of the DAX going higher.

The shape of the candlestick is like a hammer, and even if we broke down below the bottom of that I would not be bearish in this market, nor what I argue for a “hanging man.” The area underneath should continue to find plenty of buyers, so with that being the case it is likely that there will be plenty of value hunters out there looking to get involved. Remember, the DAX is highly influenced by exports as the biggest companies in that index are all heavy industrial exporters. In other words, the DAX tends to move right along with the idea of economies strengthening worldwide. This is especially true with the European Union, due to the fact that the exchange rate is not even an issue when it comes to these companies as well. If the Eurozone continues to try to strengthen, then it is very likely that we will continue to see the DAX grind higher. Regardless, we are in an uptrend and there is no point in fighting it.