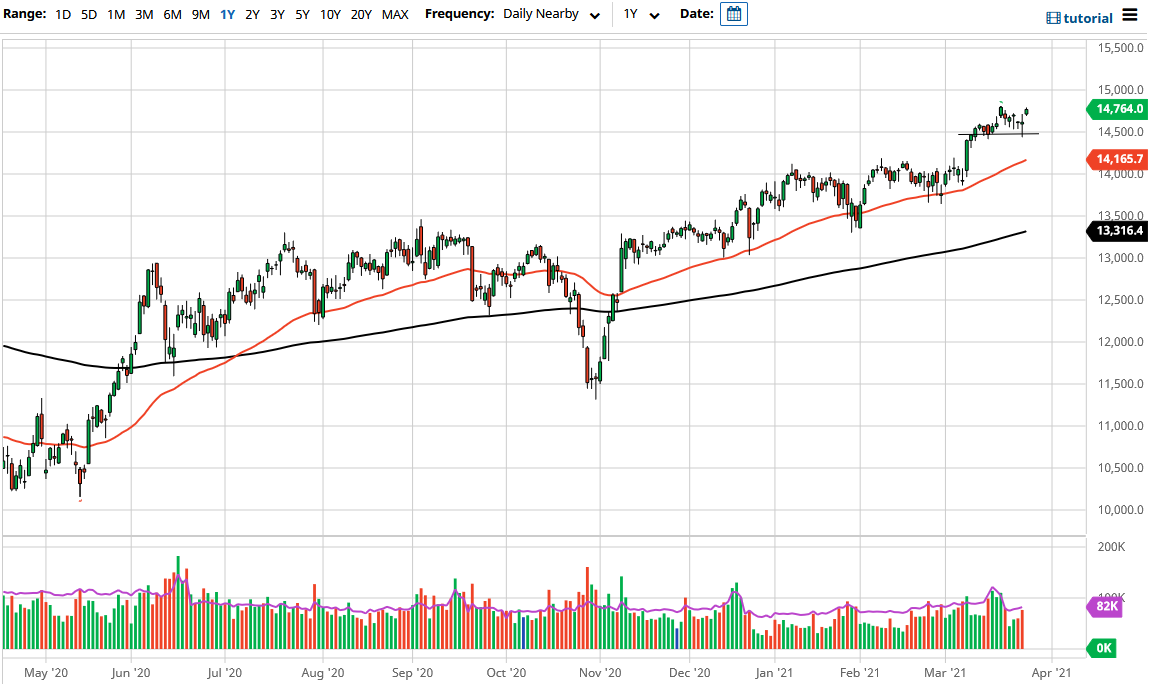

The DAX index gapped higher to kick off the trading session on Friday, and then rallied just a bit more to test the highs that we had recently made. By doing so, the DAX looks as if it is ready to break out to the upside, and it is worth noting that we had recently seen a lot of buyers every time we dip. This makes sense, because the DAX is without a doubt one of the mainstays of the European Union, so if you are going to put money to work in the EU, Germany is one of the first places you look.

It currently looks as if the 14,500 level underneath is massive support, so I look at that as a “floor in the market” currently. To the upside, I believe that the 15,000 level is a target that a lot of people are looking at, and I also would recognize that there should be a significant amount of interest and perhaps potential “pushback” in that general vicinity. The market certainly looks as if it will continue to be a “buy on the dips” type of scenario.

The Thursday candlestick is very neutral, so the fact that we broke above the top of that long range certainly is very bullish. If and when we can finally take off to the 15,000 level and clear it on a daily close, then it is likely that we will continue to see this market move much higher. In fact, it would enter more or less a “buy-and-hold” type of scenario. This will be especially true as the world opens back up from the pandemic, as the German economy is highly levered to global growth as it is such a major industrial exporter.

Furthermore, if you are going to put money to work in the European Union, the “blue-chip index” without a doubt is the DAX, as Germany is roughly 80% of GDP. With that being the case, I think this is the first place people put money to work, and then as risk appetite continues to expand and improve, then you start to look at other indices such as the Ibex, CAC, MIB, etc. In general, this is the first place people go, but then you will see other indices eventually pick up momentum. We are not there yet, so Germany continues to be the biggest game in town.