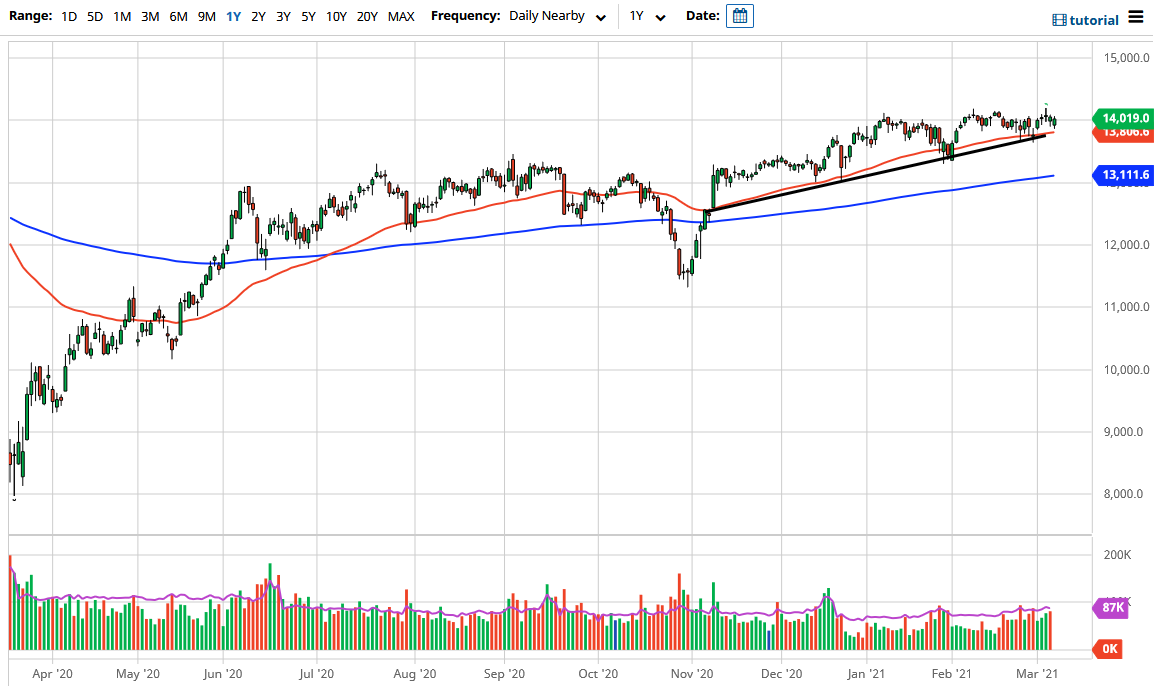

The DAX index initially gapped lower to kick off the trading session on Friday, but as turned around to show signs of strength and managed to break above the 14,000 level. That is a bullish sign, but at the end of the day we have an uptrend line that we are paying close attention to. The uptrend line has been important the whole year, and we have the 50-day EMA sitting just above the uptrend line as well. The market looks as if it is trying to find some type of buying opportunity on dips, as we continue to be choppy yet positive.

Keep in mind that the DAX is moving right along with other indices around the world when it comes to the idea of the “reopening trade”, and the possibility of massive amounts of industrial demand. The DAX is heavily laden with huge industrial corporations that export from Germany into all parts of the world, so that has a certain amount of influence as well.

The Wednesday candlestick was a shooting star, so for me that is the trigger to start buying again. After all, it was the recent high, so if we make a “higher high”, then I think that we are going to go looking towards the 14,250 level, possibly even the 14,500 level. Longer term, I believe that we are going to go all the way to the 15,000 level, so I would be willing to “buy-and-hold” to a certain extent.

If we do break down below the 50-day EMA and the uptrend line, then it is possible that the market could go looking towards the 13,500 level, possibly even the 200-day EMA, which is currently sitting at the 13,111 level. However, that 200-day EMA is rising right along with the 50-day EMA, showing that even the longer-term momentum favors the upside. I have no interest in shorting this market, at least not until we break down below the 200-day EMA. This is simply a “buy on the dips” type of situation, at least until we can break out to the upside and then I can hold onto a winner and add to it in little bits and pieces along the way to the 15,000 level.