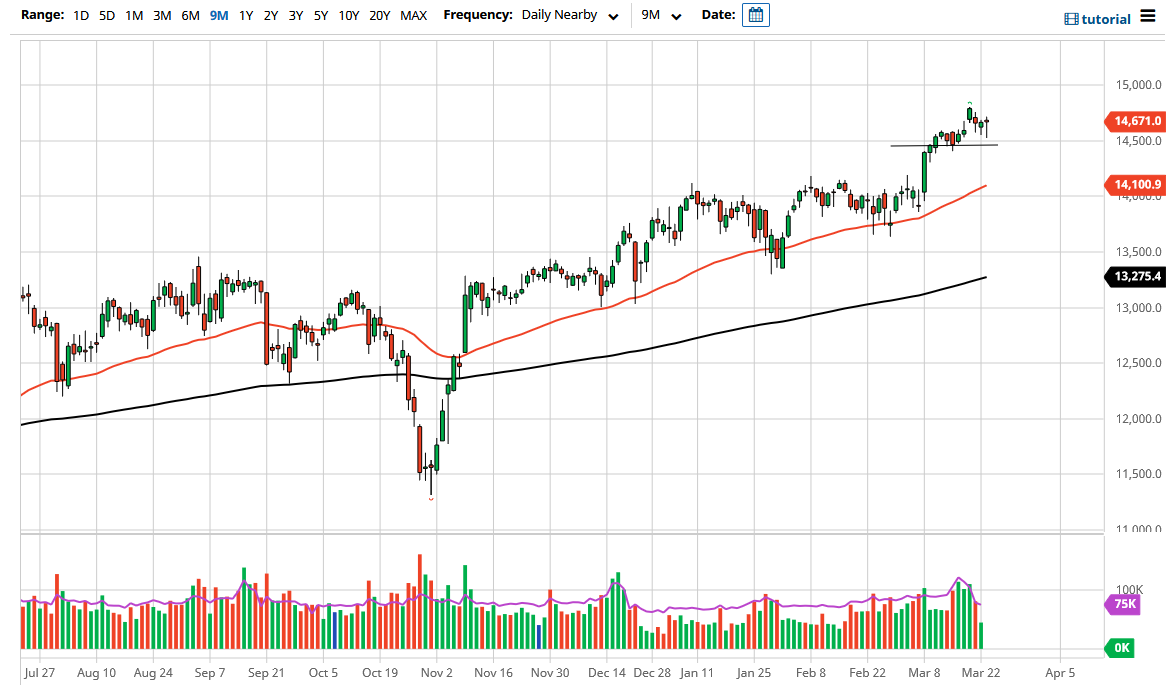

The German index initially pulled back a bit during the course of the trading session on Tuesday as we have seen more lockdowns coming to Germany. However, this is a resilient index as you can tell, and it should also be noted that the lock down is only being increased for five or six days as far as tightening restrictions even further. Because of this, I think that the market initially had a bit of an overreaction to the downside, but by the time traders had absorbed everything that happened it was not as bad as the initial knee-jerk reaction suggested.

Looking at the 14,500 level, you can see that we have seen a lot of support over the last couple of weeks, and that of course continues to ring true after the Tuesday session. The fact that we ended up forming a hammer right on this level tells me that we are more likely than not going to continue to go higher, to reach towards the 15,000 level. I do not know how long it is going to take to get there, but it certainly seems to be that the 15,000 level is the target going forward.

Even if we did break down below the 14,500 level, then I think there are other areas that you would have to be looking at as potential buying opportunities. The first one would be the 14,250 level, and then possibly the 14,000 level. The 14,000 level is a large, round, psychologically significant figure, and an area where we see the 50 day EMA sitting at. You can see that there has been a lot of action in this area, so I think that continues to come into play as well.

Further possibly pushing this market to the upside is the fact that the Euro is starting to show signs of softening as well, so it will possibly drive the DAX higher as exports will become cheaper from Germany, which is a major part of the DAX index itself. In other words, I do not see a scenario in which I would be a seller anytime soon, as we have been in such a nice uptrend for so long, and I do believe that sooner or later we will have traders just itching to reach towards the 15,000 level.